Get 40,000 Avios with the new British Airways Premium Plus American Express® Card

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

This article is an advertisement feature by American Express

Today, 20 years into their partnership, British Airways and American Express® have revealed their new-look British Airways American Express® Credit Cards which come with a host of improvements.

The changes to Card benefits were announced in June so nothing here should come as a surprise to you, although it is worth running over them again.

What wasn’t announced in advance is the huge jump to the Premium Plus Welcome Bonus which increases to 40,000 Avios for applications approved by 2nd November.

There is a second article looking at the changes to the free British Airways American Express Credit Card which you can find here. This article looks at the changes to the British Airways Premium Plus Credit Card.

The interest rate on the Card is 101.1% APR variable, based on a notional £1,200 credit limit and a £250 annual fee. The interest rate on purchases is 24.5% APR variable.

Details of the changes can also be found on ba.com here. You can apply for the British Airways Premium Plus Card here.

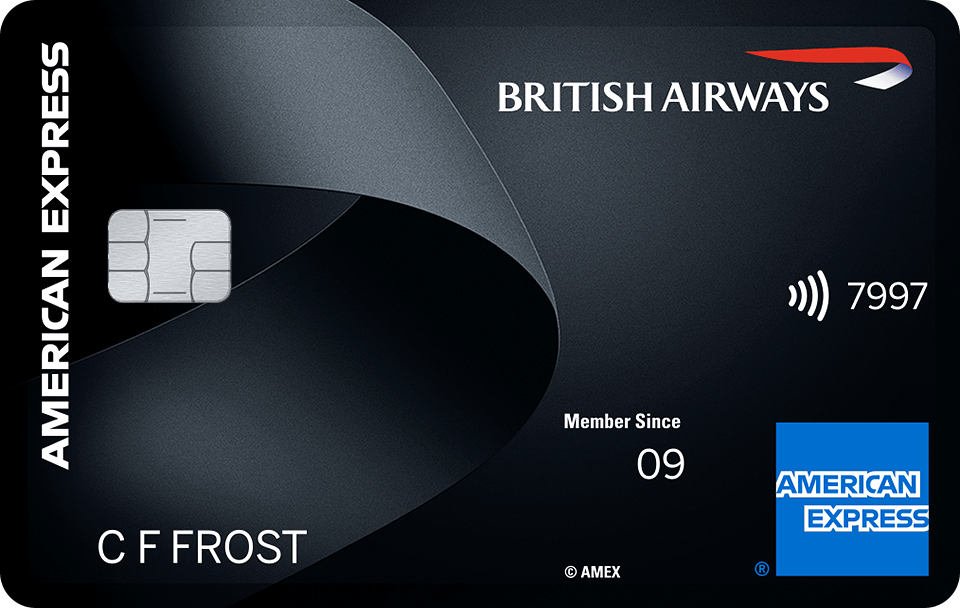

The British Airways Premium Plus American Express has a fresh new look

As you can see above, the Card has a new look, inspired by the British Airways speedmarque.

Your Card number and expiry date have moved to the back of the Card.

Get a limited time 40,000 Avios sign-up bonus!

New Cardmembers can earn a Welcome Bonus of 40,000 Avios when you spend £3,000 in the first three months. This is the most generous bonus we have ever seen on the Card. To be eligible for the increased bonus you must apply by 2nd November.

Remember that you are only eligible for the sign-up bonus on this Card if you have NOT held a British Airways American Express (free or Premium Plus) Card in the past 24 months.

You ARE eligible if you currently or have held The Platinum Card, Preferred Rewards Gold Card, Green Card, Nectar Card, Platinum Cashback Cards, Marriott Bonvoy Card, American Express Rewards Credit Card, Business Platinum or Business Gold Cards.

You ARE eligible if you are currently a supplementary Cardholder on a British Airways American Express Card held by someone else, but have not held a Card in your own name in the past 24 months.

What has changed with the British Airways Premium Plus American Express Card?

The changes to the British Airways Premium Plus American Express Card are not just cosmetic.

You should now find it substantially easier to redeem your 2-4-1 Companion Voucher for seats in Club World or Club Europe.

Here are the key changes which you need to understand and which may impact whether you decide to keep the Card or downgrade to the free version.

New Companion Vouchers will have access to extra Business Class availability

Companion Vouchers issued from today will have access to a FAR wider pool of Business Class seats.

In technical terms, if a flight is showing I-class availability (I-class is BA’s selling class for discounted non-refundable Business Class cash tickets) then the chances are these seats will be bookable for Avios.

We need to see the real life impact of this change, but on paper it should revolutionise your ability to book Business Class seats on the flight you want. It doesn’t mean you can book on any flight – there will be days when BA doesn’t need to sell discounted Business Class tickets – but your odds are hugely improved.

For clarity, this new benefit only applies to new Companion Vouchers earned after 1st September 2021. Any existing vouchers you have will be subject to the old rules.

The spend target to receive a Companion Voucher remains £10,000 per Card year.

Avios availability is improved across all classes, whether you have a voucher or not

There was a hugely positive change to the Avios programme in May 2021 when British Airways announced that it would be releasing at least 14 seats per flight for Avios redemptions.

The airline now guarantees, when booking opens at 355 days before travel:

- 8 seats in World Traveller / Euro Traveller

- 2 seats in World Traveller Plus (long haul only)

- 4 seats in Club Europe / Club World

This represents a substantial improvement on the previous guaranteed minimum of six seats. There were previously no guaranteed World Traveller Plus seats at all.

As usual, it is likely that more Avios seats will be released over time depending on how well a particular flight is selling for cash. You can be certain, however, that there will be at least 14 seats per long haul departure and 12 seats per short haul flight.

ALL Avios collectors benefit from these changes, not just holders of British Airways American Express Cards.

Your Companion Voucher flights no longer need to depart from the UK

There is another new benefit which is available to holders of both British Airways American Express Cards.

Historically, your 2-4-1 Companion Voucher flight had to depart from the UK. Since this was a benefit for UK American Express Cardmembers, it was not a major restriction.

The rule has now gone. A flight booked with a new Companion Voucher issued after today (there is no rule change to existing vouchers) can start outside the UK.

There are some scenarios where this may prove useful. If you wanted to reduce the taxes and charges you pay, you could book a reward flight from, say, Dublin or Amsterdam via London to somewhere. This would mean that there was no Air Passenger Duty to pay – although you would need to pay to get to Dublin or Amsterdam to start your trip.

You cannot merge ‘new’ and ‘old’ Companion Vouchers on the same booking

One feature of the Companion Voucher is that you can use two vouchers in the same name to book for a group of four people. The voucher rules normally insist that the Cardmember is a traveller but this is waived on the second voucher if two are redeemed at once.

However, it is not possible to use an ‘old’ (pre September 2021) and ‘new’ (post September 2021) together in the same booking. If you already have an unused Companion Voucher you cannot combine it with any you earn from today.

This will wash through over time and become less of an issue as older vouchers get used up or expire.

The annual fee is increasing to £250

The annual fee on the British Airways Premium Plus American Express Card modestly increases from £195 to £250 from today.

If you are an existing Cardmember, the new fee will apply from your next renewal. You will receive the new Card benefits immediately.

The fee waiver for long-term holders of The Platinum Card has ended. If you received your Premium Plus card for free or at a discounted rate because you held The Platinum Card in 2001 when it launched, this benefit has been withdrawn. You will be charged £250 on your next card anniversary.

The other Card features remain unchanged

The other benefits of the Card remain as they were:

- you earn 1.5 Avios for every £1 spent on the Card

- you earn 3 Avios per for every £1 you spend with British Airways or BA Holidays via their call centre or ba.com

- Companion Vouchers remain valid for two years from the date of issue (the outbound flight must be taken by the expiry date)

- after the limited time offer of 40,000 Avios expires, the Welcome Bonus returns to 25,000 Avios if you qualify

- Invite a Friend bonus Avios, once the current limited time offer ends, and access to Amex Offers remain as they were

Companion Vouchers issued in 2021 will continue to come with an additional six months validity – so 30 months on Premium Plus – as part of BA’s coronavirus mitigation measures.

Should you consider the fee-free British Airways American Express instead?

I would expect most Head for Points readers to be happy with the new benefits package.

If you are considering the Card but don’t spend enough to generate a Companion Voucher, or are not earning enough Avios due to reduced flying to book long haul business class redemptions, you may want to consider the ‘no fee’ British Airways American Express Card.

From today, the Companion Voucher on the free British Airways American Express requires just £12,000 of spending. The Companion Voucher is only valid for Economy flights, however.

The free British Airways American Express application form is here.

Conclusion

British Airways and American Express have made a conscious decision to put some clear blue water between the two Cards.

From today, the British Airways Premium Plus American Express Card is the best choice for the serious Avios collector. This person wants to redeem in premium cabins and will benefit from the additional Business Class availability that the new-style Companion Vouchers offer.

For the more casual Avios collector who is happy to redeem for Economy flights, the free British Airways American Express Card may now be more attractive. You save £250 of annual fee and benefit from the reduced £12,000 threshold for triggering the Companion Voucher.

You can find out more about the changes on this page of ba.com.

You can apply for the British Airways Premium Plus American Express Card by clicking here. Remember that the 40,000 Avios Welcome Bonus is only available for applications approved by 2nd November.

American Express Services Europe Limited has its registered office at Belgrave House, 76 Buckingham Palace Road, London, SW1W 9AX, United Kingdom. It is registered in England and Wales with Company Number 1833139 and is authorised and regulated by the Financial Conduct Authority.

Disclaimer: Head for Points is a journalistic website. Nothing here should be construed as financial advice, and it is your own responsibility to ensure that any product is right for your circumstances. Recommendations are based primarily on the ability to earn miles and points and do not consider interest rates, service levels or any impact on your credit history. By recommending credit cards on this site, I am – technically – acting as a credit broker. Robert Burgess, trading as Head for Points, is regulated and authorised by the Financial Conduct Authority to act as a credit broker.

Rhys

Rhys

Comments (211)