NEW: Earn Nectar points on in-store spending with Nectar Connect

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

Nectar Connect, which lets you earn Nectar points from your day-to-day card spending, has now launched.

Like other schemes, Nectar Connect lets you earn points from spending on your existing credit or debit cards. You do not need to waive or scan any other card and you DON’T need a Nectar-branded credit card. Points are accrued in the background, with Nectar liaising directly with your card provider.

You can opt in to Nectar Connect here.

How to sign up to Nectar Connect

You can sign up to Nectar Connect online or via the Nectar app. An invite to the scheme should be prominently displayed.

Click through and you are given a brief summary of why you should opt in to Nectar Connect (click to enlarge):

The following page details the terms and conditions and privacy policy, which you must agree to.

Are there privacy concerns with Nectar Connect?

As per the terms and conditions, you must to give Nectar Connect access to all payment transactions and transaction history from the cards you link:

“As part of Nectar Connect, we will be able to view the payment transactions and transaction history of any debit card or credit card that you link to Nectar.

This account linking and viewing of payment transaction data is required for us to operate Nectar Connect.

This data will be added to your Nectar profile, so we can analyse and understand your shopping behaviour over time and target you with relevant offers from Nectar & our partners.”

Nectar will NOT just be using your card data to award you points from participating retailers. It will be actively mining all of your credit card spending information to find ways of pushing new deals at you.

If privacy is a concern for you, you may prefer not to opt in to Nectar Connect.

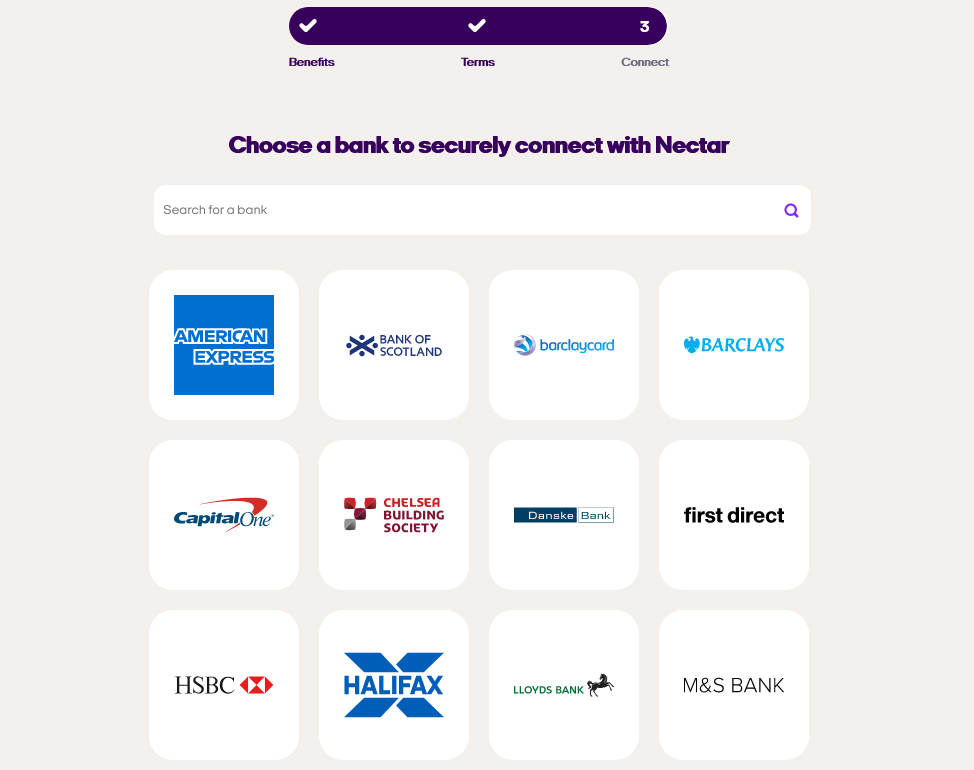

Linking your debit or credit cards to Nectar Connect

Once you’ve agreed to the terms you can connect your debit or credit card. You can connect more than one card. It’s not clear if there is a limit on the number of cards.

Note that, if you have registered for other similar schemes which offer in-store spending rewards, you may get ‘offer clash’ and your Nectar reward may not trigger in favour of another scheme.

It should double-up with any American Express cashback rewards, however, as these are managed differently.

Nectar Connect is compatible with most banks and credit card companies. The full list includes:

- American Express

- Bank of Scotland

- Barclaycard

- Barclays

- Capital One

- Chelsea Building Society

- Dankse Bank

- First Direct

- HSBC

- Halifax

- Lloyds

- M&S Bank

- MBNA

- Monzo

- Nationwide

- Natwest

- RBS

- Revolut

- Sainsbury’s Bank

- Santander

- Starling

- TSB

- Tesco Bank

- Wise (formerly Transfer Wise)

- Ulster Bank

- Virgin Money

- Yorkshire Building Society

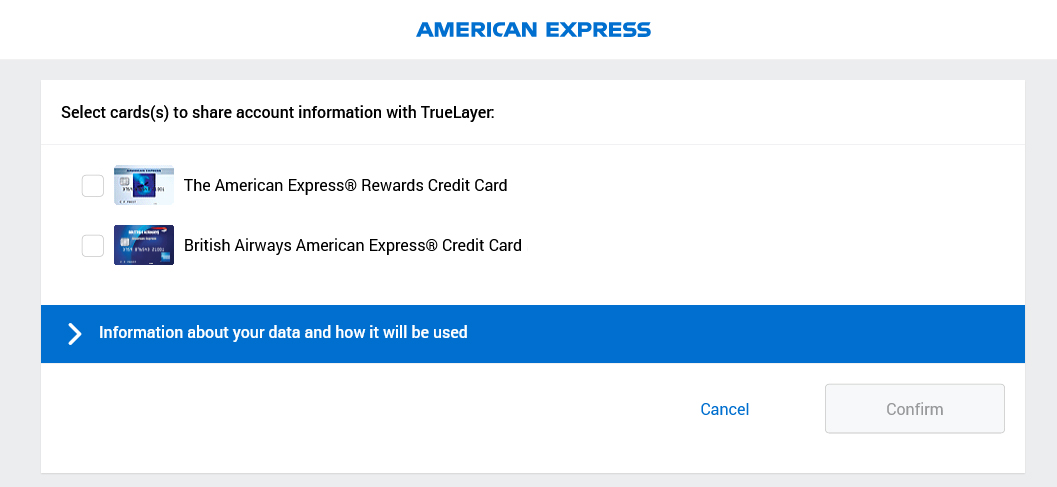

Connecting your card is easy and is performed via TrueLayer technology. This means that Nectar will direct you to your bank which will let you choose which cards to connect once you have logged in.

For American Express this is as simple as selecting the card you want to connect:

Once selected you are redirected to Nectar Connect and the process is complete.

Note that any cards you add will automatically be removed from Nectar Connect after 90 days unless you choose to renew each connection. This seems quite aggressive and is possibly driven by regulation, since there is no benefit to Nectar in throwing you out of the scheme every 90 days. You can revoke card access at any time.

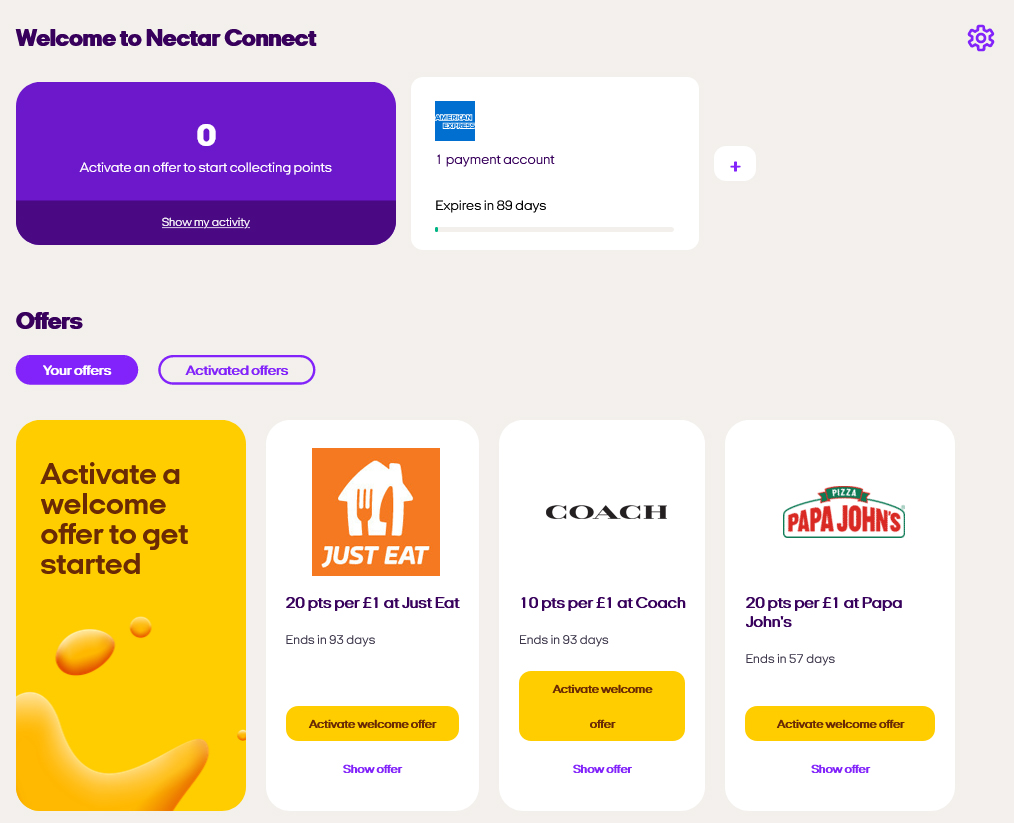

What retailers currently have Nectar Connect offers?

Once you have linked your cards you are shown a list of retailers. These are some of the ones I had:

As you can see, the list of offers is pretty small right now. The full list is Just Eat, Coach, Papa John’s, Pets at Home, Costa, Interflora, QUIZ, Harvey Nichols, Kate Spade and Lakeland.

Note that you must opt in to each offer to be eligible: you will not be automatically enrolled.

All my offers are for a minimum of 10 Nectar points per £1 spent, which is not bad. The highest offer I had was for 30 points per £1 spent. This is the equivalent to earning 18.75 Avios per £1 if you convert your points under the new Nectar/Avios program.

Nectar has told us it is working with 150+ retailers to source offers from, so we should see more as time goes by.

It is worth giving Nectar Connect a go and seeing what offers you get – it is an easy way of picking up a few Avios. If you don’t want to continue you can always revoke access to your cards. You can opt in to Nectar Connect here.

How to earn Avios from UK credit cards (December 2021)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points, such as:

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Run your own business?

We recommend Capital On Tap for limited companies. You earn 1 Avios per £1 which is impressive for a Visa card, along with a sign-up bonus worth 10,500 Avios:

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

You should also consider the British Airways Accelerating Business credit card. This is open to sole traders as well as limited companies and has a 30,000 Avios sign-up bonus:

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

(Want to earn more Avios? Click here to visit our home page for our latest articles on earning and spending your Avios points and click here to see how to earn more Avios this month from offers and promotions.)

Rob

Rob

Comments (80)