Review: the Currensea travel money card – a new low-fee way to spend abroad

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

This is our review of the Currensea travel money card. Is it worth getting one? It is free, after all!

Currensea is an interesting new fintech company which I was introduced to earlier this year by a reader.

It has won a few awards over recent months for what it does (offering you a low-cost way to spend abroad) but what I like about Currensea is that it is simple as hell. This is a good thing.

Currensea is, effectively, a direct debit travel card. It is a Mastercard which sits between you and your existing current account. There is nothing to top-up or prepay. You simply spend as you would on a normal debit card and the money is taken from your current account – just without the usual 3% fee.

Oh, and Currensea is free to apply for, which also helps.

There are also some interesting travel benefits if you choose a paid plan, but the free plan works fine. You can apply here.

There is a business model in fintech which Curve, Revolut, Monzo etc have all followed:

- launch by doing one thing well, and for free or cheaper than the competition

- add more and more features which your existing customers don’t really need or want

- add fees, charges or restrictions to the feature that made people get your product in the first place, removing any competitive advantage

Currensea is currently still in Stage 1 of this process and will hopefully stay there. Curve, Revolut and Monzo are already in Stage 3 ….

What is Currensea?

Currensea is simple enough that it passes my ‘Can you explain it to your mate in the pub in 30 seconds?’ test:

It is a free direct debit card to use abroad and which automatically recharges all purchases to your existing current account in Sterling, less a small 0.5% fee.

That’s it.

You don’t (yet ….) earn any airline miles or points for using it.

Why would I want to get a Currensea card?

If you have a credit card offering 0% foreign exchange fees, then you don’t need a Currensea card, unless you want free ATM withdrawals. You can stop reading now.

However, credit cards which offer rewards and charge 0% FX fees are few and far between. The new Barclays Rewards card is the best option and even pays you 0.25% cashback. The snag is that you are adding another credit card to your credit report and it may restrict your options to get future cards. With Barclays now having an Avios relationship, I’d also be wary of getting any products from them which could stop you getting a ‘new to bank’ bonus later.

Currensea IS possibly for you if:

- you don’t have a credit card offering 0% FX fees and do not want to impact your credit report by getting another credit card specifically to use abroad

- you want a product which allows you to make £500 of foreign currency ATM withdrawals per month with no fees and only a minimal FX mark-up (there is a small fee beyond £500)

- you want a product for you, your adult children, parents, partner or anyone else in your life who needs a simple, easy to understand payment card that will save them money when travelling

How does Currensea work in practice?

It is, as I said earlier, a very simple process. You use your Currensea card in the same way as your existing debit card.

- You make your purchase in local currency (any currency, globally)

- Your current account bank automatically confirms that you have enough money in your account and authorises the transaction

- The transaction goes through at either the interbank rate or the Mastercard rate, depending on the currency. Currensea adds a 0.5% fee if you have the free card. There are no fees if you have one of their paid cards.

- You get an automatic spend notification via the Currensea app, if you choose to install it

- The money is taken from your current account a few days later

Here is an example. With no foreign travel in the diary, I decided to splash out and buy 1,000 MeliaRewards points for €5.

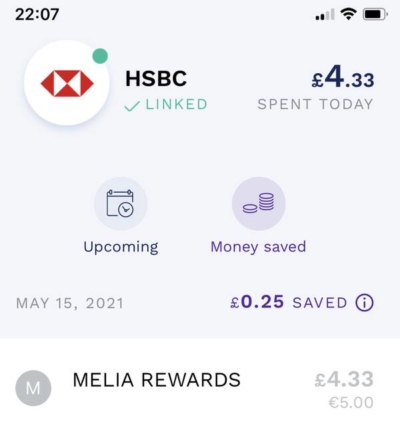

This is what you see in the Currensea app, which shows £4.33 scheduled to leave my HSBC account a few days later:

I checked the interbank rate after doing the transaction and, adjusting for the 0.5% FX fee, it did match the rate used by Currensea. There is a more detailed transaction analysis which shows the exact FX rate used.

A few days later, on the day specified in the original transaction confirmation, the charge hit my HSBC account:

What exchange rate does Currensea use?

Currensea offers 16 major currencies at the real (interbank) rate (EUR, USD, AUD, CAD, CHF, DKK, HKD, HUF, JPY, NOK, NZD, PLN, SEK, SGD, THB and ZAR) and an additional 164 currencies at the Mastercard rate, which is marginally away from interbank. On the free Currensea plan, you pay this rate plus 0.5%.

Note that, for the 16 currencies where Currensea uses the interbank rate, I am told that you will get a similar deal – even with Currensea’s 0.5% fee – to using a 0% FX credit card which uses the Mastercard or Visa rate.

Note that, unlike Curve, Revolut etc, there are NO ‘weekend surcharges’, ‘top-up fees’, ‘fair use fees’ etc etc. As I said at the start, this is a very simple and idiot-proof product with no hidden charges.

There are three versions of the Currensea card

The Currensea website is here. Whilst you apply online, it has an app which lets you monitor transactions on the go.

There are three products to choose from:

- a free card (totally free, there isn’t even a delivery fee) called ‘Essential’ which charges a 0.5% FX fee on purchases and ATM withdrawals

- a £25 ‘Premium’ version which has no FX fees

- a £120 ‘Elite’ version which has no FX fees, Avis ‘President’s Club’ status, use of the ‘Ten’ concierge service, access to Mastercard’s luxury hotel booking service (stays come with extra benefits) and LoungeKey airport lounge access (£20 fee per visit payable)

The £25 version is better value if you would spend over £5,000 per year on the card, but frankly I’d suggest getting the free card to see if you like it and then upgrading later.

Can you use Currensea at cash machines abroad?

Yes. You can withdraw up to £1,000 per month from ATMs outside the UK.

The standard 0.5% fee applies to the first £500 per month but there is an additional 1.5% fee between £500 and £1,000. You can avoid this fee by making payments directly with the card rather than paying with cash, although obviously this isn’t always possible.

The fees are lower if you have the Premium (1% between £500 and £1,000) or Elite (1% between £750 and £1,000) versions of the card.

Can you use Currensea in the UK?

The card is not designed to be used in the UK – and there is no logical reason to do so, given that you can use your exising bank debit card for free – but you can do so if you wish. There is a daily limit of £250, however. You cannot use it for ATM withdrawals in the UK.

Do I have protection for my purchases?

Currensea is a debit card, not a credit card, so you don’t have the legal protection offered by Section 75. This is the same position you are in if you use Curve, Revolut or any other debit card, or indeed an American Express charge card.

You DO have Mastercard chargeback protection, which allows you to file a claim directly with Currensea. They will liaise with Mastercard for any disputed transactions and in most cases the coverage is very similar to section 75.

How to apply for a Currensea card

To apply for a Currensea card, you must have a current account with one of the following banks:

Barclays, Bank of Scotland, First Direct, Halifax, HSBC, Lloyds, Nationwide, NatWest, RBS, Santander, TSB, Ulster Bank

It doesn’t work with any of the ‘challenger’ banks.

You apply here and it is a very simple process. You will need the sort code and account number for your current account to set up the direct debit.

When I applied, I had the card within three days. It is, as the images above show, a funky vertical shape. Activate it via the Currensea website or app and you’re away.

Is Currensea worth getting? I think so

This is a fairly short article (by HfP review standards) because Currensea is a very simple product. The bottom line is that:

- Currensea is free, if you choose the free ‘Essential’ plan – you don’t even pay for postage

- You can use it wherever Mastercard is accepted

- On the free plan, you pay a fixed 0.5% FX fee on non-Sterling spend, seven days per week

- The money is taken from your linked current account a few days later

Simple. If you, or someone you know, needs ‘simple’ then Currensea is worth a look.

If you would spend a lot of money on the card, or simply want to buy yourself Avis status, then the premium options with a 0% FX fee are also worth a look.

You can find out more, and apply, on the Currensea website here.

Comments (117)