How can American Express improve its cashback ‘statement credit’ offers?

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

There is no doubt that the American Express cashback rewards programme is very popular.

Many HfP readers generate substantial savings from it. We often see people saying in our comments that the ability to save via Amex cashback is a key reason why they continue holding their card, even if it has an annual fee.

Just because something is good doesn’t mean that it can’t be improved, however.

Here are a few ideas from myself and from reader comments. If you have any others, please post them below and we can add them in. You can be sure that Amex will read them.

How to improve American Express cashback rewards

Put new offers at the top of the list, not randomly inserted into it

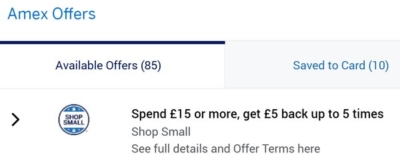

As you can see here, my wife currently has 95 offers on her Preferred Rewards Gold card:

Because I’m weird, I am happy to scroll through the 85 unsaved offers on a regular basis to see what is new. However, the biggest mistake that people who work in the loyalty business make is to assume that all of their customers are as committed / obsessed / weird as they are.

Put the new offers where they can be seen – at the top. Even better, send out a weekly personalised email of new offers.

Allow offers to be dismissed or removed from the list

If new offers can’t be put at the top of the list, or perhaps even if they can, include an option to dismiss or hide offers which are irrelevant.

Amex may say ‘well, you never know what you may end up needing’. Whilst this is the case for some retailers (my wife may announce tonight that she has found something on FARFETCH she wants to buy) I can promise you that I won’t be spending £50 on mail-order steak or £650 on a Brighton & Hove Albion season ticket.

Allowing deals to be dismissed would also give Amex valuable data on what offers to show to you in the future.

List offers by category, or at least allow filtering by category

Some sort of deal filtering would help. If someone is looking for a hotel, putting the relevant offers together in the list or allowing the list to be filtered to just show hotel offers would be useful.

Clarify what an offer is about

Again, this comes back to the disconnect between the Amex staff who put these offers together and Mr Average Cardmember.

I can get £10 back at ROWBOTS. What is this? Where is it? If I already know what the business does, then arguably I am less likely to need a cashback incentive to check it out. Explain it to potential new customers. List it as ‘ROWBOTS boutique fitness studio’.

Get on top of the small print

We get hundreds of comments on HfP each year questioning the small print – more precisely, the lack of it – on Amex cashback offers.

The most common problem is over whether an offer is cumulative or not. This crops up primarily with the hotel offers. You will occasionally see wording such as ‘spend £350 in one transaction’ but the lack of this wording does not necessarily mean that cumulative spending is acceptable.

For example, I have a Blacklane (high end chauffeur service) offer on my Platinum card. It is worth £25 back on a spend of £100.

You would assume this is cumulative, since even if I took Blacklane to Heathrow it wouldn’t come to £100. The wording, however, says “get a £25 statement credit on an eligible transaction of £100+ online at Blacklane”. This implies that the £100 must be done in one transaction. Am I going to risk putting £100 through Blacklane over 2-3 trips just to see if the cashback appears? No.

The Dell cashback offer for Amex Business cardholders is equally confusing. For some reason the small print suggests you use an Amex-branded link to the Dell site. In reality, the cashback works perfectly well on Dell Outlet, the Dell trade site and the Dell personal site.

Find a way around the problem with sign-up caps

Most of these cashback offers have a limited number of registrations, often 5,000 to 10,000 people. This is peanuts compared to the number of Amex cards in circulation.

Retailers want caps in place because they want to restrict their financial exposure. Having talked to companies who have run Amex cashback offers, however, they create more problems than they solve.

Here are some of the issues:

- some people ‘save’ offers purely to get rid of them from their offers list, to make new offers easier to spot. This reduces the number of genuine potential users who can register. This problem can be fixed if Amex allowed people to dismiss or hide offers that don’t interest them

- some people ‘save’ offers even if there is only a 1 in 1,000 chance that they might use them. There is no downside and they don’t want to run the risk of losing out if the offer disappears. I can understand why people do this – it is economically rational – but it causes real issues for the retailer if people who register only have a 0.1% likelihood of redeeming

- some people do not save the offer immediately (which is the ‘responsible’ thing to do) but when an unexpected requirement to spend £500 at Agent Provocateur comes up, they can no longer find it. This is because other people – who have no intention of visiting Agent Provocateur but ‘saved’ the offer due to the two reasons above – have taken all of the registration spots. Annoyed, the customer decides to spend their £500 elsewhere because they feel they are somehow being ripped off if they still visit Agent Provocateur.

There is an obvious way around these problems, which is to set a cap on the number of REDEMPTIONS. This would cause its own problems, because you wouldn’t know before you made a purchase whether the cashback would appear or not. This isn’t something Amex would want to do.

Another option would be to allow people to un-save an offer. A little nudge (“Won’t use this? Unsave and let another cardholder benefit”) would do the job. It could then be shown again to cardholders who were originally offered it but didn’t save it before it disappeared.

I wish there was an easy answer to this one, but there isn’t.

The only real solution is that Amex and advertisers learn from previous behaviour. If an airline has a £100,000 budget and estimates that 10% of people who ‘save’ will redeem a £100 cashback offer, it will set a limit of 10,000 registrations. If it turns out than only 1% do redeem, it should adjust the next offer to allow 100,000 registrations – possibly with Amex sharing some of the financial risk.

Do you have any other suggestions for this list?

The ideas above will all improve the effectiveness of American Express cashback rewards for Amex, retailers and cardholders. Some will not be easy to implement, but others – especially making the terms and conditions crystal clear – won’t cost a penny.

If you have any other ideas, please comment below.

Amex …. my invoice is in the post.

PS. Here are some additional ideas submitted via the comments:

- Remove the ‘show all’ button and simply show all of the offers in one list in the first place

- Restrict the number of offers that can be saved per card, coupled with the ability to unsave other offers to free up space

- Insist that an offer be redeemed within x days of being saved to your card, or it is removed

- Speed up the process for saving offers by removing the need for a ‘double click’

- Improve the wording on ‘percentage’ offers – does ‘get 20% back up to £100’ mean you can earn £20 or £100 cashback?

- Add a progress counter for those offers which are triggered by cumulative spend

Want to earn more points from credit cards? – December 2021 update

If you are looking to apply for a new credit or charge card, here are our November 2021 recommendations based on the current sign-up bonus.

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the top current deals:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers.

American Express Business Gold

20,000 points sign-up bonus and free for a year Read our full review

American Express Business Platinum

40,000 points sign-up bonus and a long list of travel benefits Read our full review

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending:

Barclaycard Select Cashback Credit Card

1% cashback and no annual fee Read our full review

Comments (152)