Which energy suppliers let you pay your bill with an American Express card?

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

Gas and electricity is a substantial monthly outlay for most people, but it is rare that you find a way of putting the cost of gas and electricity onto an American Express card.

This is unfortunate, as it would make a major dint into the spend you need to trigger a sign-up bonus or your annual British Airways American Express 2-4-1 companion voucher.

There IS a way to pay via credit card, however, and it works with many of the newer suppliers. You are unlikely to get very far with any of the legacy utility companies, unfortunately.

How to pay your energy bill with an American Express card

Whilst most energy suppliers will prefer to set up a monthly or quarterly direct debit to keep costs down, many will let you top-up your account at any time.

This can often be done using an American Express (or other credit) card.

Doing a top-up does NOT mean that your next Direct Debit payment is not taken. Energy companies will try to charge you a flat monthly figure throughout the year even though your usage is higher in Winter. This means you build up a balance during the Summer and it unwinds during the Winter. Making a top up payment simply increases this balance.

Some suppliers do, however, let you reduce your monthly direct debit, although it may depend on how much of a buffer you have in your account.

Your money should be safe if you do top-up. Whilst a lot of small energy companies have gone bust in recent years, Ofgem has a system in place to ensure whoever takes over your account honours outstanding credit balances. If this failed – which seems unlikely – you would still have protection via your payment card.

Using American Express with Bulb

Rob has used Bulb for a couple of years for his gas and electricity.

Bulb operates differently to most companies, having only one tariff. There is no ‘introductory’ rate or other deals – everyone gets the same price, and that price is fixed at a small margin above the wholesale rate. Whilst an introductory deal from another company may be cheaper in the short term, Bulb works fine for anyone who wants to switch once and then not think about it for five years, confident that the deal will always be ‘market’.

If you are concerned about your environmental impact, 100% of Bulb’s electricity is renewable and their gas supply is 100% carbon neutral.

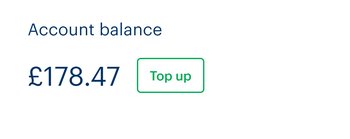

To top up your Bulb account with an American Express card, head to your ‘Payments & Statements’ page on their website. You will see:

If you click the ‘Top up’ box, you get taken to the payments processor Stripe:

…. and you can see American Express as a payment option. It works fine – Rob has done it.

Even better, when Rob moved house last year and closed his Bulb account (and then opened a new one at his new property), the credit balance on his account was paid out in cash to his bank …..

Bulb has a £50 refer a friend sign-up bonus if you sign up for electricity and gas or £25 for one fuel. Rob’s wifes refer a friend link is here.

Using American Express with Octopus Energy

Octopus Energy is another supplier that will let you top up your account with an American Express card, as Rhys has found.

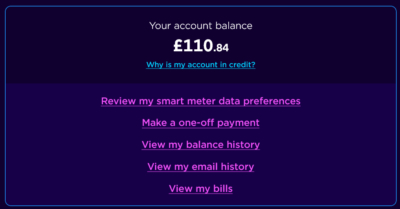

To top-up your account, click on ‘Make a one-off payment’ in your account:

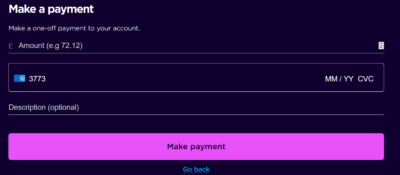

Once done you are taken to a payment page. As you can see, inputting the first four digits of your Amex card show that it is working:

You can reduce your direct debit to as low as £1 per month in your online account to avoid overpaying.

Like Bulb, Octopus supplies 100% renewable electricity and also offers a £50 refer a friend sign-up bonus when you sign up via this link. This also applies for London Power, which piggybacks on Octopus Energy.

You can also sign up via the Virgin Red app, which offers you 7,400 Virgin Points for a dual fuel switch and 3,700 Virgin Points for a single fuel.

If you are not a Virgin Red member, you will need to register – free – here.

This works for other providers too

According to recent comments on HfP, a number of other energy suppliers let you pay via American Express. No-one on the HfP team has any experience of these suppliers, however.

These include:

- Igloo

- Avro

- People’s Energy

- Outfox the Market

- Green

These are smaller players in the energy market but, as mentioned above, you should be protected in case the company goes bust by both Ofgem and your payment card under Section 75 coverage.

Please do leave a comment below with your experiences of these companies – I’m sure this would be appreciated by other readers. We will update the list above during the day with any additional reader suggestions.

Want to earn more points from credit cards? – December 2021 update

If you are looking to apply for a new credit or charge card, here are our November 2021 recommendations based on the current sign-up bonus.

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the top current deals:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers.

American Express Business Gold

20,000 points sign-up bonus and free for a year Read our full review

American Express Business Platinum

40,000 points sign-up bonus and a long list of travel benefits Read our full review

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending:

Barclaycard Select Cashback Credit Card

1% cashback and no annual fee Read our full review

Comments (156)