How ‘taxes and charges’ on Avios redemptions from the US got out of control

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

The level of ‘taxes and charges’ added to long-haul Avios redemptions on British Airways is always a sore point.

In general, I use a ‘finger in the air’ sum of £550 for the taxes and charges on a Club World or First return redemption from London (£650 for North America) whenever anyone asks what they will be.

That obviously isn’t small change, but it still gives acceptable value for your points most of the time as long as you are redeeming for Club World or First. The biggest threat to Avios – given BA’s dominant UK position – is not from other frequent flyer schemes but from aggressive sale fares from other airlines.

When you have Qatar Airways regularly offering Business Class tickets to Asia for £1,000 in a sale, admittedly starting elsewhere in Europe, for a superior product then it offers clear competition. It also earns Avios and tier points.

Avios is, of course, under threat from other angles. You can switch from a BA credit card to a different rewards credit card. You can convert Nectar points, Heathrow Rewards points or Amex Membership Rewards into a different treat.

You can only squeeze things so far, and £1 earned by Avios from Sainsburys is worth a lot more – because it is ‘real’ money – than £1 transferred across intra-group from British Airways. If people stop seeing value in the scheme, IAG Loyalty will stop seeing the money coming in.

But be grateful you don’t live in the US ….

What you might not realise, if you live in the UK, is how reasonable BA’s ‘taxes and charges’ are compared to what a US resident must pay.

The ‘charges’ element of ‘taxes and charges’ is just a made up number, which BA pockets. It doesn’t actually reflect anything in particular and it has no qualms about changing it on a market by market basis.

Here’s a little Sunday quiz.

The ‘taxes and charges’ on a Club World return ticket from London Heathrow to New York JFK are £675.

(It is worth noting that this number has increased by £140 since I last did this exercise in 2017. Only North America has seen such increases – taxes elsewhere have remained roughly flat since 2017, adjusting for Air Passenger Duty.)

What do you reckon the ‘taxes and charges’ are on a Club World return ticket from New York JFK to London Heathrow and back? Here’s a clue – it isn’t £675.

£500?

£600?

£700?

£800?

£900?

£1,000?

No, sorry, you’re still wrong.

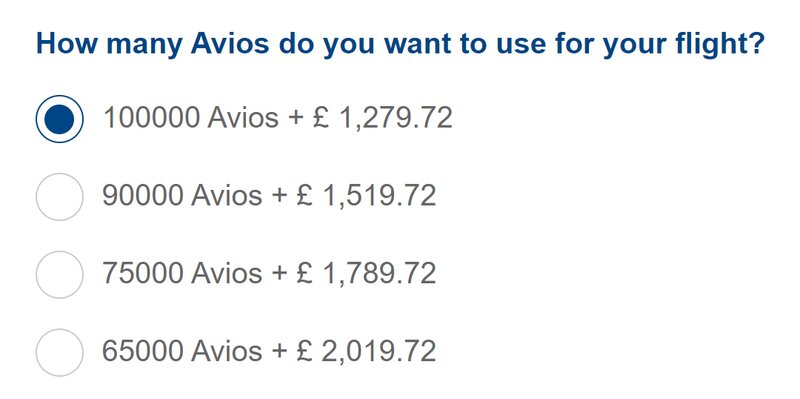

The actual figure is an astonishing £1,279 return.

You can prove this yourself by doing a dummy booking on ba.com. You need to click through to the payment page for it to recalculate to the exact number.

You should see this:

Why is this?

It isn’t entirely clear why BA treats North America like this.

You don’t see it with other markets. A return Club World redemption to Dubai is £542. Book the trip in reverse and you pay £561. That’s near enough the same, given currency fluctuations.

One view is that, because Avios are so easy to earn in the US (BA has, in the past, given out 100,000 Avios as a credit card sign-up bonus) it tries to create a level playing field with the UK by adding extra charges. This ‘protects’ UK Avios collectors because it reduces the willingness of US members to redeem on transatlantic flights, with many choosing to use them on domestic American Airlines and Alaska Airways flights instead. This is only a theory though.

Even if you live in the UK, there is a lesson here

If you are booking Avios tickets to North America, do NOT book them as 2 x one-way tickets. This is because the ticket from London will attract the lower UK level of ‘taxes and charges’ whilst your flight home, when booked on a separate ticket, will attract the higher US level of ‘taxes and charges’.

For example, as we noted above, a return ticket from the UK to New York has Club World taxes of £675.

Booked as a one-way in each direction, the total taxes are £455 outbound and £523 inbound, for a total of £978.

You should bear this in mind if, for example, you see a special one-way cash offer from a low cost airline from the UK. Don’t think that booking the outbound flight to the US for cash and then using Avios for the return is a good deal, because you will be paying an inflated level of ‘taxes and charges’ on the flight back.

PS. Remember that using your Avios to fly on Iberia saves hugely on taxes and, for the US East Coast, Avios.

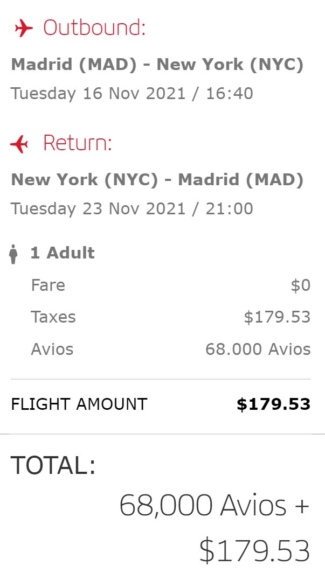

An off-peak Business Class return from Madrid to New York, booked via the Iberia Plus website to avoid BA surcharges, costs just 68,000 Avios + $180, a huge saving:

You can learn more about redeeming Avios on Iberia here.

How to earn Avios from UK credit cards (December 2021)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points, such as:

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Run your own business?

We recommend Capital On Tap for limited companies. You earn 1 Avios per £1 which is impressive for a Visa card, along with a sign-up bonus worth 10,500 Avios:

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

You should also consider the British Airways Accelerating Business credit card. This is open to sole traders as well as limited companies and has a 30,000 Avios sign-up bonus:

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

(Want to earn more Avios? Click here to visit our home page for our latest articles on earning and spending your Avios points and click here to see how to earn more Avios this month from offers and promotions.)

Comments (47)