Why is British Airways charging lower taxes to inactive Avios members?

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

A few readers have been in touch in recent weeks to highlight weird pricing behaviour by British Airways. What was confusing is that I assumed there would be a common theme, but there isn’t. This article covers the oddest one.

British Airways is charging lower taxes on long-haul economy Avios redemptions if you are an inactive member of the Executive Club.

An ‘inactive’ member is someone who has not earned or spent 1 Avios in the previous 12 months. You will know if you are ‘inactive’ if you try to make a short-haul redemption and don’t see the usual Reward Flight Saver pricing options of £35 and £50 of taxes and charges.

How does British Airways change long-haul Avios pricing?

Rather than explain what I mean, it is easier to show you.

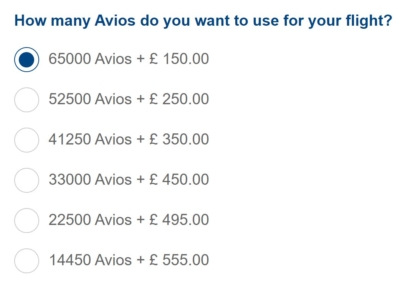

Here is the Avios pricing I see for an Economy redemption to San Francisco:

As you can see, the options run from 65,000 Avios + £150 through to 14,450 Avios + £555.

Let’s ignore whether this is good value or not for a flight in August – because it probably isn’t – and move on.

My imaginary friend Steve is going to come with me. He has an inactive Avios account – totally inactive, actually, as it has a zero balance because I only opened it 5 minutes ago.

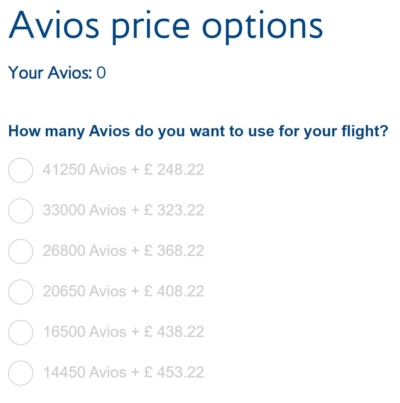

Let’s assume that Steve does really have a lot of Avios but this account has simply become inactive due to no activity over the last year, which is far from impossible at the moment. Here is what he sees:

Apologies for the light grey text above. This is due to ba.com changing the screen colour if you can’t afford the booking you are searching.

As you can just about see, the pricing ranges from 41,250 Avios + £248 to 14,450 Avios + £453.

Steve, as an inactive member, is getting a FAR better deal than me (or you).

I could pay 52,500 Avios + £250, whilst inactive Steve pays 41,250 Avios + £248.

I could pay 14,450 Avios + £555, whilst inactive Steve pays 14,450 + £453.

I am either 10,000 Avios or £100 worse off, depending on which pricing option I choose.

This doesn’t apply to Business Class

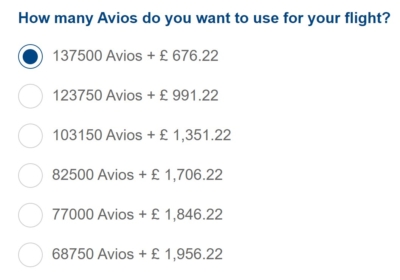

Here is my pricing in Club World:

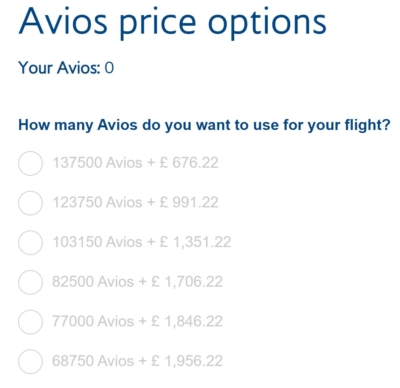

Here is what an inactive member gets (apologies again for the grey text due to the zero Avios balance):

The numbers are identical for both active and inactive members.

Conclusion

I have no idea what is causing this difference in Economy Avios flight pricing. It is also not clear who is ‘right’ – is the inactive member being undercharged, or are active members (the majority of us) being overcharged?

Unfortunately there is nothing you can do about it, unless you know someone with an inactive Avios account with enough points to book the flight you want.

Once they have booked it, of course, their account will stop being inactive and they won’t be able to get the same deal on their next booking ….

You just need to cough up the extra £100 or 10,000 Avios.

How to earn Avios from UK credit cards (December 2021)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points, such as:

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Run your own business?

We recommend Capital On Tap for limited companies. You earn 1 Avios per £1 which is impressive for a Visa card, along with a sign-up bonus worth 10,500 Avios:

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

You should also consider the British Airways Accelerating Business credit card. This is open to sole traders as well as limited companies and has a 30,000 Avios sign-up bonus:

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

(Want to earn more Avios? Click here to visit our home page for our latest articles on earning and spending your Avios points and click here to see how to earn more Avios this month from offers and promotions.)

Comments (65)