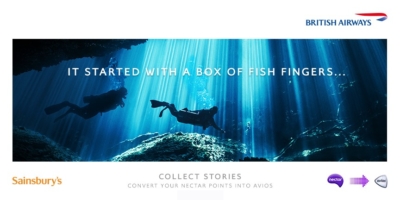

Sainsbury’s is the new Avios supermarket partner!

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

Yes, you read that right. Sainsbury’s has just been unveiled as the new Avios-earning supermarket partner.

Oddly, this isn’t the most important part of the announcement. What has been announced today will change the way you think about your Avios and how you spend them.

Am I overstating this? Not necessarily.

Nectar points and Avios are to become interchangeable. Every route to earning a Nectar point is now a way of earning an Avios. Perhaps more importantly, every way of spending a Nectar point is now a way of spending Avios.

Given that, until today, your Avios spending options were restricted to flights, wine, car hire and hotels, this is a huge shift.

This is going to take a while to explain. This article focuses on the Sainsbury’s relationship and the Nectar conversion rate. A second article on Nectar and Avios – click here, but read this one first – starts to look at some of the new options available to you.

Let’s jump in.

What is the conversion rate between Nectar and Avios?

The conversion rate will be:

- 250 Avios = 400 Nectar points

- 400 Nectar points = 250 Avios

Here is the key thing: there is no value loss in either direction. You can transfer your points as often as you want and you will still have the same amount you started with.

In theory, you could now keep your entire Avios balance with Nectar and just move the points across to Avios as you need them. There is no benefit to doing this, but you won’t lose out either.

An online tool will be available from Monday to allow you to move your points back and forth. I am assuming it will be instant.

A Nectar point is worth 0.5p isn’t it?

Yes. 99% of Nectar redemptions get you 0.5p per Nectar point. This means that you can look at the conversion offer like this:

- 250 Avios = 400 Nectar points = £2

- So …. 1 Avios = 0.8p

Since Nectar points are arguably almost as good as cash if you live in the UK since you can use them at Sainsburys, Argos, eBay and various other places at 0.5p per point, Avios points now have a floor value of 0.8p.

We will explain the impact of this in Part 2, but it is fundamental.

What will I earn at Sainsbury’s?

On the face of it, the headline earning rate is poorer than Tesco.

You earn 1 Nectar point for every £1 you spend in Sainsbury’s. This means £1 spent in Sainsbury’s will earn you 0.625 Avios based on the 400 : 250 conversion.

In reality, it doesn’t work like this.

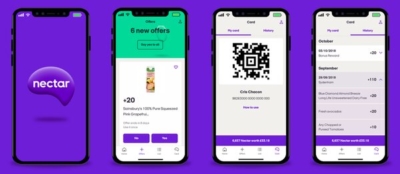

When Sainsbury’s reduced its earning rate from 2 Nectar points per £1 to 1 point per £1 a couple of years ago, it introduced ‘in app’ offers on top.

Each week you are offered a large number of bonus point offers via the app or website. Importantly, these are often for products that you normally buy. These are, effectively, extra base points as long as you buy what you usually buy – and as long as you remember to register for all the offers in the app.

I am told that the average number of Nectar points earned per £1 is substantially higher than the headline number of 1 per £1 due to these bonus points.

When does the new partnership start?

You will be able to convert Nectar points into Avios from next Monday.

However, nothing stops you from shopping in Sainsbury’s today and collecting Nectar points for your spending. You can then transfer them next week.

If you don’t have a Nectar card, you can register via nectar.com, via the Nectar app or by picking up a temporary card in a Sainsbury’s store.

Is there a bonus to support the new partnership?

Yes.

If you convert at least 1,600 Nectar points into Avios before 14th February, you will receive a bonus of 500 Avios.

1,600 Nectar points would usually get you 1,000 Avios, so you will get 1,500 Avios instead.

Sainsbury’s is also giving you something. You will earn double Nectar points (2 per £1) on all shopping at Sainsbury’s between 25th January and 19th April.

Conclusion

I know this is a lot to take in ….. and wait until you read Part 2!

The bottom line is that I think this is a very positive move for Avios collectors.

You may or may not find that you earn the same number of Avios from your Sainsbury’s shopping as you did from Tesco, when all of the bonus Nectar points are taken into account.

The real win is that, because you can now convert 250 Avios into £2-worth of Nectar points, your Avios now have a minimum value of 0.8p each. This should change how you think about collecting Avios – and the choices you make to do so – and should also change how you spend them.

More on this to come.

As far as Head for Points goes, it will mean changes to how we operate. Any deal offering bonus Nectar points is now, by default, a deal offering bonus Avios.

Whilst a lot of Nectar partners have gone in recent years, there are still strong offers from Sainsbury’s Bank and Sainsbury’s Energy amongst others. Earning partners include Esso, Argos and numerous rail franchises. We will explore some of these deals in the coming weeks.

Click for the second part of our Nectar and Avios introductory coverage, where we look at possible arbitrage opportunities.

PS. Here’s your first odd arbitrage. You will be able to order any hot or iced drink, any size, at Caffe Nero for the equivalent of 219 Avios (350 Nectar points). For lovers of super-sized iced drinks, this suddenly becomes the best Avios redemption you can get!

How to earn Avios from UK credit cards (December 2021)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points, such as:

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Run your own business?

We recommend Capital On Tap for limited companies. You earn 1 Avios per £1 which is impressive for a Visa card, along with a sign-up bonus worth 10,500 Avios:

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

You should also consider the British Airways Accelerating Business credit card. This is open to sole traders as well as limited companies and has a 30,000 Avios sign-up bonus:

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

(Want to earn more Avios? Click here to visit our home page for our latest articles on earning and spending your Avios points and click here to see how to earn more Avios this month from offers and promotions.)

Rob

Rob

Comments (546)