MBNA Smart Rewards – the new cashback scheme – is now live

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

Back in November, we tipped you off about the upcoming launch of MBNA Smart Rewards.

This is MBNA’s attempt to compete with Amex’s market-leading cashback offers. It is now active.

Many HfP readers have an MBNA credit card because at one point it issued 13 different airline cards.

With the introduction of the cap on interchange fees, MBNA decided to withdraw from the affinity market and put itself up for sale, eventually being purchased by Lloyds Bank.

When those cards closed, most cardholders were offered a market-leading card called Horizon with no foreign exchange fees and 0.5% cashback. I think most people who got offered it decided to keep it, because it is a decent option for overseas spend.

How does ‘Smart Rewards’ work?

At present, MBNA Smart Rewards is only available via the website. It is apparently coming to the app soon. This is good news because, as the app is OK, I hadn’t used the website for well over a year until I was researching this piece yesterday.

There is more information here on their website and a FAQ here.

When you log in to the website, you will see a reference to ‘Smart Rewards’. Click on that and you will be asked if you want to activate it or not.

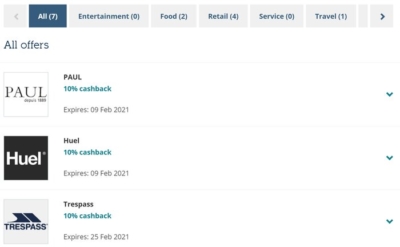

You will see a screen like this:

As with Amex, you need to manually opt in to each offer that you think may interest you.

Cashback will be added to your card balance once per month. You will be able to see ‘pending’ payments online so you will know that an offer has successfully triggered.

I have seven offers showing at the moment:

- Paul – 10% back

- Huel – 10% back

- Trespass – 10% back

- Byron – 5% back

- Europcar – 5% back

- Land’s End – 15% back

- Fortnum & Mason – 5% back

One obvious problem is that, as the screenshot shows, it is not immediately clear that you need to opt in. You need to click the little ‘down’ arrow for the registration box to show. I can imagine a lot of people not realising that registration is required.

This clearly isn’t a life-changing selection but, given the current lockdown, it would be unfair to judge how it will develop.

Want to earn more points from credit cards? – December 2021 update

If you are looking to apply for a new credit or charge card, here are our November 2021 recommendations based on the current sign-up bonus.

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the top current deals:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers.

American Express Business Gold

20,000 points sign-up bonus and free for a year Read our full review

American Express Business Platinum

40,000 points sign-up bonus and a long list of travel benefits Read our full review

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending:

Barclaycard Select Cashback Credit Card

1% cashback and no annual fee Read our full review

Rhys

Rhys

Comments (45)