How to maximise the ‘£50 American Express cashback with PayPal’ offer

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

As we covered last week, American Express has launched a cashback deal with PayPal. It is effectively free money if you are targeted for the offer.

There seem to be two versions, one for personal cards and one for business cards.

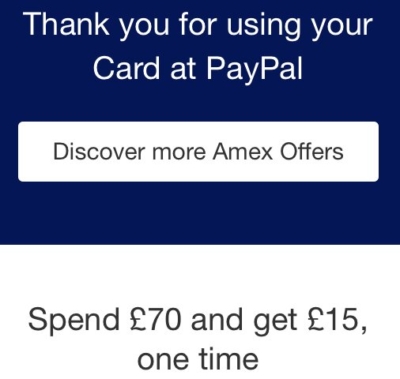

On my Marriott Bonvoy American Express, I am offered £15 cashback on a £70 PayPal payment.

On my Business Platinum card I am offered £50 cashback on a £250 PayPal payment.

Both offers expire on 4th March. Registrations are limited so register now via your online Amex statement or the app if you are targetted.

Here are two things about the offer you may not know.

Cumulative spend counts

Despite the wording on the offer, it IS valid on cumulative spend.

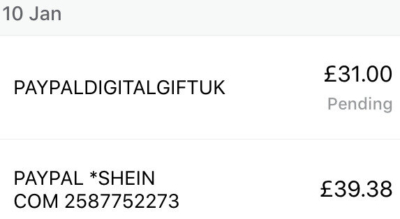

I proved it myself. Here is a screenshot from my Marriott Bonvoy American Express showing £70 of spend across two transactions:

….. and here is the email Amex sent me after the 2nd one had gone through:

It works when you buy gift cards from PayPal’s gift card service

You may not know that PayPal has a dedicated website selling gift cards – you can find it here.

Look at my 2nd transaction above. You will see that it is from the gift card site.

I bought a £31 Netflix gift card, to tip me over £70. Netflix, if you pay for it, is a good choice here. You can add the credit very quickly via netflix.com, and it will automatically stop your direct debit or credit card payment whilst it works through the balance.

PayPal also sells Uber gift cards which is an easy option if you use that a lot. Apple App Store and Google Play cards are also available.

Netflix gift cards are emailed to you as codes so you don’t need to worry about anything going missing in the mail.

Hopefully these two tips will make it easier for you to trigger the cashback. You have until 4th March to do the £70 or £250 target spend.

Want to earn more points from credit cards? – December 2021 update

If you are looking to apply for a new credit or charge card, here are our November 2021 recommendations based on the current sign-up bonus.

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the top current deals:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers.

American Express Business Gold

20,000 points sign-up bonus and free for a year Read our full review

American Express Business Platinum

40,000 points sign-up bonus and a long list of travel benefits Read our full review

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending:

Barclaycard Select Cashback Credit Card

1% cashback and no annual fee Read our full review

Rob

Rob

Comments (67)