How to create an Amex Platinum Covid insurance certificate before you travel

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

Some countries are now insisting that you provide evidence of travel insurance for coronavirus before you will be allowed to enter the country. If travelling to such a country, it may also be required by your airline at check-in as they will face the cost of repatriating you to the UK.

If you bought a dedicated travel insurance policy then you don’t need to worry because you will have a personalised policy document. It is trickier if your coverage comes via The Platinum Card from American Express because you do not have a policy document with your name on it.

It turns out that American Express has added the ability online to generate an insurance certificate.

I thought I would write this up because, having just done this myself, I was sent on a merry-go-round between Amex and AXA before finally being told that the only way to do it was online.

How do you get an American Express travel insurance certificate?

The first step is to visit the dedicated American Express travel insurance portal which is here.

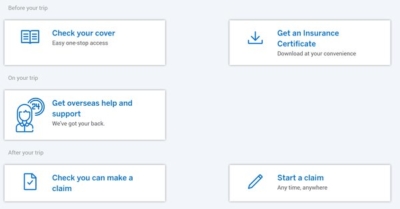

Once logged in, you will see this screen:

Click on ‘Get an insurance certificate’.

This takes you an AXA website where you need to fill in details about yourself, your card and your trip. Once you have submitted those, you are emailed the certificate immediately.

If you want to generate a second certificate in the name of your partner or anyone else covered by your policy, there is a link you can click to be taken back to the form.

The certificate comes as a PDF. You should assume that you will need to present a paper copy at the airport and immigration, not a screenshot. Make sure that you leave enough time in your planning to get it printed.

And that’s it. Once you know about the link above, it is a very fast and efficient process for Platinum cardholders.

Want to earn more points from credit cards? – December 2021 update

If you are looking to apply for a new credit or charge card, here are our November 2021 recommendations based on the current sign-up bonus.

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the top current deals:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers.

American Express Business Gold

20,000 points sign-up bonus and free for a year Read our full review

American Express Business Platinum

40,000 points sign-up bonus and a long list of travel benefits Read our full review

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending:

Barclaycard Select Cashback Credit Card

1% cashback and no annual fee Read our full review

Rob

Rob

Comments (49)