How does the Hertz and Amex Platinum ‘4 hour grace period’ work?

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

Having rented a few cars this Summer, I thought it was worth running through one of the lesser known benefits of The Platinum Card from American Express.

Most people know that Amex Platinum comes with comprehensive car hire insurance. You don’t need to agree to anything that the rental company tries to sell you. I have claimed on this a few times over the years and never had a problem. The car hire company charges you and you reclaim the bill from American Express.

Platinum also comes with elite status at Hertz and Avis, although I don’t value this much. It is worth having if you regularly rent from busy depots as it usually allows you to ignore the queue and pick up your keys from a separate desk.

The Hertz ‘4 hour’ deal is something separate. It allows you to make your final rental day a 28 hour one.

Let’s imagine that you pick up a car at 10am on Friday to return at 2pm on Monday.

Car rental companies treat this as a 4 day rental.

With Hertz, as long as you use the Amex Platinum CDP code of 633306, it prices as a 3 day rental. This is because you get a four grace period on your final day.

Where is the four hour grace period available?

According to Hertz:

“A 4-hour no charge grace period before an extra day charge is applied when returning the vehicle in Hertz Corporate Europe locations, the U.S., Canada, Latin America, Middle East (with exception of UAE and Bahrain who offer 2 hours grace period) and selected European Franchise countries (see participating countries). Asia, with the exception of China, offers a 2-hour no charge grace period, except on optional extras like portable phones.”

Here is an example.

Compare two bookings using the Amex Platinum code:

All of these quotes are taken from the UK Hertz website which is here.

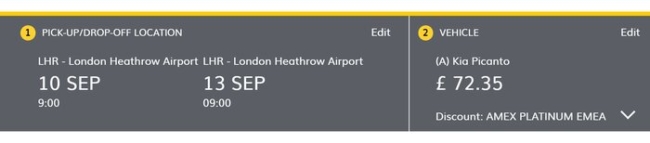

This is a Hertz rental of exactly three days using the Amex Platinum discount code, showing £72.35 as the price.

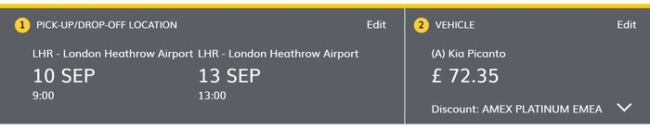

This is a Hertz rental of three days and four hours, using the Amex Platinum discount code:

As you can see, there is no difference. It is still £72.35.

Compare two bookings WITHOUT the Amex Platinum code:

To prove that the Amex code is making a difference, here is the same Hertz rental of exactly three days WITHOUT using the Amex Platinum discount code. You will see that the Platinum code has saved us £11.93 which is OK but not a fortune.

This is a Hertz rental of three days and four hours WITHOUT using the Amex Platinum discount code:

You will see that the price has shot up because you are now paying for a fourth day, even though you are returning the car just four hours into the fourth day.

For this rental, the Amex Platinum code saves us (£129.22 – £72.35) £56.87, or 44%.

Conclusion

The American Express Platinum / Hertz ‘four hour waiver’ seems like a very niche benefit, and one that you can easily overlook.

If it fits around your schedule, however, it can lead to substantial savings.

PS. You can often make additional savings by using another Amex Platinum discount code – 211762. I’m not sure where this is from, but it comes up as ‘Platinum Card from Amex’ whereas the code used above comes up as ‘Amex Platinum EMEA’.

In our example above, using code 211762 drops the price from £72.35 to £64.38.

Sign-up bonus and earnings rate:

- Get 30,000 Membership Rewards points when you spend £4,000 within three months

- Earn 1 Membership Rewards point per £1 spent

- Points transfer at 1:1 into Avios, Virgin and other airline and hotel schemes

Other information:

- Two Priority Pass cards, each allowing two people into 1,300 airport lounges

- Elite status in four major hotel loyalty programmes

- Comprehensive travel insurance

- Annual fee: £575

This is a charge card, not a credit card. You must clear your balance in full each month. Annual fee £575.

You will receive 30,000 American Express Membership Rewards points as a sign-up bonus on The Platinum Card if you spend £4,000 within three months of signing up.

Membership Rewards points are hugely flexible. You can transfer them into Avios, Virgin Flying Club or other airlines (at 1:1) or into various hotels schemes, into Club Eurostar or use them for shopping vouchers.

This is the ONLY personal American Express card where you still qualify for the bonus if you already hold a British Airways American Express card.

To qualify for the bonus, you must NOT, currently or in the previous 24 months, have held any other personal American Express card which earns Membership Rewards points. This includes The Platinum Card and Preferred Rewards Gold.

You are OK if you had a supplementary card on someone else’s American Express account.

You are OK if, currently or in the previous 24 months, you have held any other American Express card, including the British Airways, Marriott and Nectar cards.

If you cancel The Platinum Card at any point, you will receive a pro-rata refund of your membership fee. You will not lose your sign-up bonus.

For clarity, you can still apply for The Platinum Card even if you do not qualify for the bonus. You would still benefit from the long list of other benefits.

The Platinum Card from American Express comes with an unrivalled list of benefits for the keen traveller.

Your personal travel patterns will determine which of these is the most valuable. The key benefits are:

Full comprehensive travel insurance for you, your family and the family of up to five supplementary cardholders, subject to enrolment

Two Priority Pass cards, each of which allows the holder and a guest unlimited free access to 1,300 airport lounges

Elite status in four major hotel loyalty schemes: Marriott Bonvoy (Gold), Hilton Honors (Gold), Radisson Rewards (Gold), MeliaRewards (Gold)

Access to Eurostar lounges, irrespective of travel class

£10 per month of Addison Lee taxi credit

Rob

Rob

Comments (43)