Fly EL AL? It’s a new option now Qantas Frequent Flyer has joined Amex Membership Rewards

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

On Monday, Qantas Frequent Flyer became a partner of American Express Membership Rewards in the UK.

As promised, I wanted to answer the question: what are the best ways to spend Qantas Frequent Flyer points if you live in the UK? I should caveat this by saying that I have happily ignored the Qantas programme for my entire life until Monday so this has been a fairly steep learning curve.

How to earn Qantas Frequent Flyer points from UK credit cards

You can now earn 1 Qantas Frequent Flyer point for every £1 you spend on American Express Green, Gold, Platinum and Amex Rewards Credit Card cards.

You also get generous sign-up bonuses if you qualify:

20,000 points for getting American Express Preferred Rewards Gold (no fee in year 1, our Amex Gold review is here)

30,000 points for getting The Platinum Card (£575 fee, our Amex Platinum review is here)

5,000 points for getting the American Express Rewards Credit Card (free for life, our Amex Rewards Credit Card review is here)

There is no bonus on The Green Card. Our review of the American Express Green card is here.

That’s the good news.

The bad news is that Qantas Frequent Flyer is not the most competitive frequent flyer programme out there.

Unless you already have some Qantas miles, most people won’t see any value in transferring points across compared to using British Airways Executive Club. As both Qantas and BA are members of the oneworld alliance, they can generally access the same reward seats.

There are exceptions though ……

How much are Qantas Frequent Flyer redemptions?

Full details of Qantas Frequent Flyer reward pricing can be found on this page of their website. Here are the key charts you need:

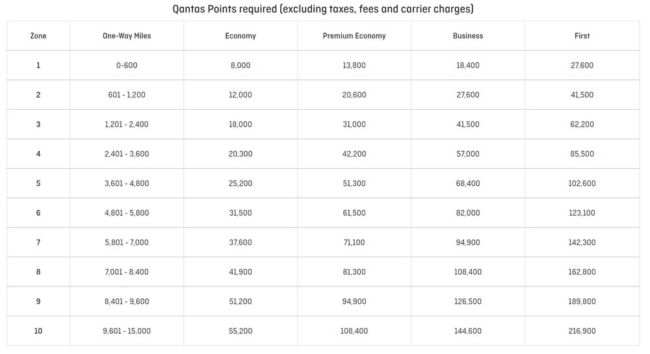

This is the chart for redemptions on Qantas, Jetstar, Fiji Airways, Air Vanuatu, American Airlines and Emirates (for Emirates bookings up to 31 August 2020):

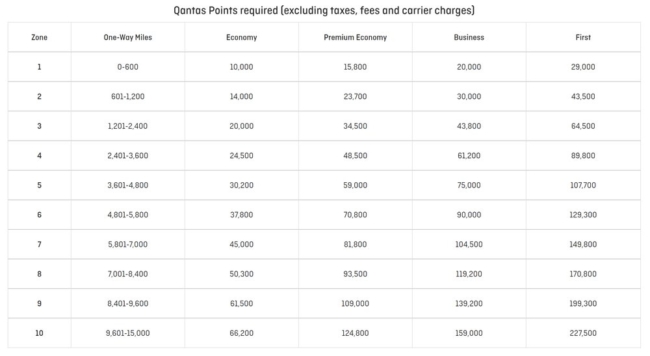

More relevant, this is the chart for redemptions on Air France, Air Niugini, Alaska Airlines, British Airways, Cathay Pacific Airways, China Airlines, China Eastern, Cathay Dragon, EL AL, Emirates (for Emirates bookings from 1 September 2020), Finnair, Iberia, Japan Airlines, KLM, LATAM Airlines, Malaysia Airlines, Qatar Airways, Royal Air Maroc, Royal Jordanian, S7 Airlines and SriLankan Airlines:

These charts are for one-way flights. A return is priced as two x one-way flights. You do NOT double the mileage and use the price based on the mileage for a return flight.

This pricing is in line with what you would pay via British Airways Executive Club. Once you factor in the ability to also earn Avios via other partners, and of the course the 2-4-1 voucher from the British Airways American Express credit card, there is little point considering Qantas Frequent Flyer as a transfer partner for booking a BA flight.

Here are the airlines on the list above which CAN’T be booked using Avios via British Airways:

- Air Niugini

- EL AL

- Emirates

- Fiji Airways

- Air France

- KLM

I will focus on EL AL and Emirates in this article, as Air France / KLM flights can be booked via Virgin Flying Club or their own Flying Blue scheme, both of which are already Amex transfer partners.

Using Qantas Frequent Flyer points to book EL AL flights

EL AL is not big on partnerships, to put it mildly. According to wheretocredit.com, it only works with:

- Aerolineas Argentinas

- Qantas

- Alaska Airlines

This means that Qantas Frequent Flyer is the ONLY easy way to redeem miles for EL AL flights via UK credit card spend.

London Heathrow to Tel Aviv is 2,233 miles according to Great Circle Mapper. From Manchester it is 2,355 miles. This means that both fit into the same Qantas Frequent Flyer pricing zone:

Economy: 20,000 miles each way

Business: 43,800 miles each way

For comparison, Avios would charge 12,500 Avios one-way in Economy and 37,500 Avios one-way in Club World, based on peak dates.

Virgin Flying Club would charge 11,000 miles one-way in Economy and 33,000 miles one-way in Upper Class, based on peak dates.

Qantas does have low surcharges when you redeem on EL AL. You save around £100 compared to booking British Airways return flight using Avios (roughly £250 vs £350).

What IS a good deal is just booking a flight TO the UK on EL AL. The taxes and charges for Tel Aviv to London in Business Class, one way, are just £25.10.

EL AL is also a great deal on taxes if you book from outside the UK. Here are some examples:

Amsterdam to Tel Aviv (one-way) – €31.44 in Business

Tel Aviv to Amsterdam (one-way) – £25.10 in Business

One option would therefore be to fly out from Amsterdam, to benefit from the lack of Air Passenger Duty, whilst flying back directly to the UK.

Use Qantas Frequent Flyer points to book Emirates flights

I also wanted to quickly touch on Emirates.

American Express Membership Rewards is a 1:1 partner with Emirates Skywards anyway. In general, unless there is some big discrepancy in pricing on a particular route, it would make more sense to convert Amex points to Emirates Skywards and redeem with them directly. Amex transfers to Emirates are instantaneous.

London Heathrow to Dubai is 3,421 miles. This means you are looking at:

Bookings to 31st August: 20,300 miles one-way in Economy, 57,000 miles one-way in Business, 85,500 miles one-way in First

Bookings from 1st September: 24,500 miles one-way in Economy, 61,200 miles one-way in Business, 89,800 miles one-way in First

Qantas reward pricing increases at 3,600 miles but it seems that all UK Emirates departure points make it (Edinburgh to Dubai is 3,594 miles) EXCEPT Glasgow.

Let’s compare with Emirates Skywards. Emirates redemptions require fewer miles when booked as a return so I have quoted return prices from London Heathrow below:

Economy return: 45,000 Skywards miles + £189

Business return: 90,000 Skywards miles + £373

First return: 135,000 Skywards miles + £373

Assuming that taxes are the same, there is no real advantage to using Qantas Frequent Flyer to book Emirates UNLESS you already have some Qantas points and want to top them up via American Express Membership Rewards.

Conclusion

Whilst it is always good to see new Membership Rewards partners, in truth Qantas Frequent Flyer doesn’t add much for a UK traveller who doesn’t already have some of their miles.

It is good news for anyone who wants to redeem miles on EL AL. It also benefits anyone who flies EL AL for cash, as they could credit the miles to Qantas and top them up via Amex Membership Rewards points.

Perhaps Amex can focus on getting a UK partnership with World of Hyatt instead?! That would be a real game changer if they want to attract more spending from the frequent flyer market.

Want to earn more points from credit cards? – December 2021 update

If you are looking to apply for a new credit or charge card, here are our November 2021 recommendations based on the current sign-up bonus.

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the top current deals:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers.

American Express Business Gold

20,000 points sign-up bonus and free for a year Read our full review

American Express Business Platinum

40,000 points sign-up bonus and a long list of travel benefits Read our full review

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending:

Barclaycard Select Cashback Credit Card

1% cashback and no annual fee Read our full review

Rob

Rob

Comments (36)