Your Curve Card now works with Apple Pay

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

Curve Card launched Apple Pay integration yesterday.

This means that, at last, you can add your Curve Card to your iPhone or Apple Watch.

Whilst this was a slightly odd missing feature – Google Pay has worked with Curve for some time – it is also fair to say that it isn’t necessarily a key one. The key selling point of Curve Card is that you can consolidate all of your existing credit cards onto it, meaning that you don’t need to carry them all around. This isn’t a problem with Apple Pay, since you can add all of your existing cards anyway and it doesn’t make your phone any heavier.

The only obvious upside is if you have a Visa or Mastercard which does not work with Apple Pay. You can now get around this by linking it to a Curve Card. The same goes for any card you may have which does not support contactless payment, as Curve Card is contactless. You can also route foreign currency payments via Curve to avoid the 3% FX fee on your underlying card.

You can learn more about Curve Card in our main reference article here. Curve Card is FREE and, indeed, Curve will pay you £10 for trying it out if you use our link.

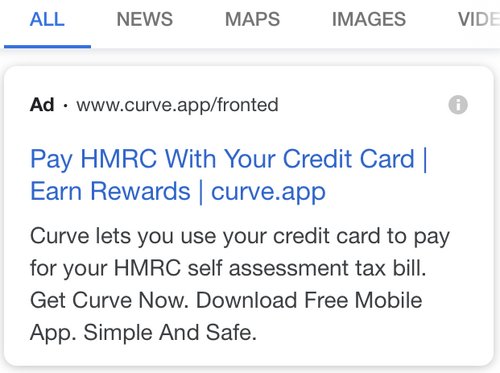

PS. As regular readers will know, you can no longer use Curve Card to pay HMRC for free. Unless you have Curve Metal at £14.99 per month, Curve now adds a 1.5% fee to your HMRC transactions. In virtually all scenarios, this means that it makes no sense to use Curve to pay your tax, even though you will receive receive points on the underlying Visa or MasterCard you link to Curve.

There is no Mastercard or Visa where the points are worth 1.5%. You could make a case for the Virgin Atlantic Reward+ Mastercard which earns 1.5 miles per £1, so you are ‘buying’ miles at 1p, but I still see that as a bit toppy.

And yet, as you can see below, Curve is now actively advertising on Google (bidding against the phrase ‘HMRC’) the ability to use it to circumvent the rules banning credit card payments. Very odd.

Want to earn more points from credit cards? – December 2021 update

If you are looking to apply for a new credit or charge card, here are our November 2021 recommendations based on the current sign-up bonus.

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the top current deals:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers.

American Express Business Gold

20,000 points sign-up bonus and free for a year Read our full review

American Express Business Platinum

40,000 points sign-up bonus and a long list of travel benefits Read our full review

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending:

Barclaycard Select Cashback Credit Card

1% cashback and no annual fee Read our full review

Rob

Rob

Comments (141)