What does Revolut for Business have to offer small companies?

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

What does Revolut for Business have to offer small companies?

We recently took another look at the Capital On Tap range of Avios-earning business payment cards. These are extremely generous, offering you up to 1 Avios per £1 spent if you choose to convert the points earned to British Airways.

A reader dropped us a note to say that Revolut has also just relaunched its business cards. Whilst this is not strictly miles and points related, we thought it was worth taking a look given the large number of SME readers we have and the fact that the non-Amex ‘miles and points’ options available are slim apart from Capital On Tap.

As a reminder, Revolut was founded four years ago. In the beginning the company promoted itself on the back of a consumer prepaid card which carried 0% foreign exchange fees and let you move money between currencies without charge. Since then it has increasingly positioned itself as a current account provider as well moving into Business services.

What are the key features of Revolut for Business?

Revolut for Business has many of the same features as the personal Revolut card including a quick online application process and the ability to have multiple accounts in different currencies.

Revolut for Business is very similar, but you can add multiple users to one master account. Each cardholder can have different permissions in terms of what and where they can spend, and Revolut has a novel function called ‘Payment Approval’ which means that users can draft payments that must be approved by senior account holders.

Just like the consumer cards, Revolut for Business comes with several different pricing levels, although there is a free plan.

Free: this is the basic card and allows you to have two cardholders, no 0% FX allowance

Grow (£25/month): up to ten cardholders, £10k in fee-free foreign spend at interbank rates and perks

Scale (£100/month): up to thirty cardholders, £50k fee free foreign spend at interbank rates and perks

Enterprise (£1000/month): unlimited cardholders, unlimited free free foreign spend, unlimited transfers and a range of perks

You will note that the free card does NOT comes with 0% FX fees. However, the FX fee charged is VERY low – just 0.4% – which makes Revolut for Business an attractive option for SMEs with a lot of foreign spend.

The Capital On Tap Avios-earning cards offer 0% FX fees to everyone, of course.

Revolut uses the interbank rate to calculate foreign transaction spend. This should be slightly more competitive than the exchange rates offered on Visa or Mastercard credit cards.

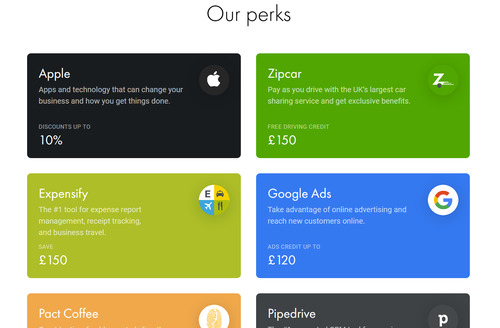

Revolut for Business has perks too

All the paid accounts come with a variety of perks, including £150 Zipcar credit, 10% off Apple products, up to £120 Google Ads credit, $100 Slack credit, and up to £100 off with Amazon Business. You can see the full list on the Revolut for Business website here.

Depending on which plan you are on and how much you have use for these products you may find that this goes some way to offsetting the monthly fees.

You can give Revolut for Business a try with the demo portal, which allows you to explore and manage an account populated with fake data.

If you own a business you may find the simplicity of applying and managing such an account to be far easier than with a legacy business bank account, and the ability to get 0% or, with the free account, 0.4% FX fees could lead to a big saving.

Further reading

If you are looking for a rewarding (in all senses of the word) payment card for your SME, we also recommend our articles on:

American Express Gold Business (review here)

American Express Platinum Business (review here)

All of these cards have VERY generous sign-up bonuses, and Amex Gold Business is FREE for the first year.

If you decide to apply for Revolut for Business, you can do so here.

Want to earn more points from credit cards? – December 2021 update

If you are looking to apply for a new credit or charge card, here are our November 2021 recommendations based on the current sign-up bonus.

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the top current deals:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers.

American Express Business Gold

20,000 points sign-up bonus and free for a year Read our full review

American Express Business Platinum

40,000 points sign-up bonus and a long list of travel benefits Read our full review

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending:

Barclaycard Select Cashback Credit Card

1% cashback and no annual fee Read our full review