Amex Platinum is letting you order a metal card immediately – and a quick benefits reminder

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

The new American Express Platinum fee and benefits package kicked in yesterday. You are now looking at a £575 annual fee, with the carrot of a £10 monthly Addison Lee credit and a metal card.

When we originally wrote about the launch of a metal card, I joked that American Express would be facing a large number of claims from existing holders of The Platinum Card who had ‘lost’ or ‘damaged’ their old plastic one.

As it happens, this isn’t necessary 🙂

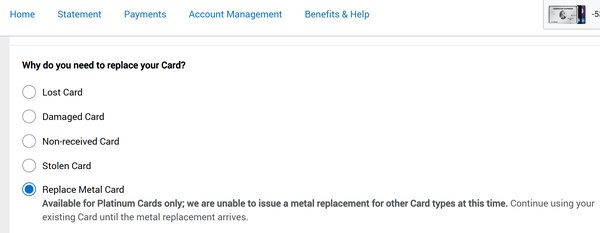

If you log in to your American Express account, click on Account Management and then Order A Replacement Card, you now see this option (click to enlarge):

Select Replace Metal Card and a new card will be sent out to you ASAP.

Don’t forget to register for onefinestay

There is one other thing to note.

The Addison Lee benefit of £10 credit per month is automatic. Remember to use code RIDE8 on your first trip, which gives you an £8 saving as long as you spend over £15.

However, the 2nd new offer – $200 cashback on every onefinestay home rental you book – requires registration.

The registration link is on the same page as registration for all of the hotel and car rental status upgrades. You need to log in and go Benefits & Help (top menu) and then Platinum Benefits.

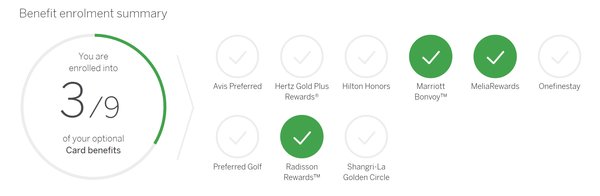

Scroll down to where it offers onefinestay enrollment and you will be taken to a screen like this (click to enlarge):

…. where you can see which Platinum benefits you are registered for. Onefinestay has been added to the top row.

Want to earn more points from credit cards? – December 2021 update

If you are looking to apply for a new credit or charge card, here are our November 2021 recommendations based on the current sign-up bonus.

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the top current deals:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers.

American Express Business Gold

20,000 points sign-up bonus and free for a year Read our full review

American Express Business Platinum

40,000 points sign-up bonus and a long list of travel benefits Read our full review

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending:

Barclaycard Select Cashback Credit Card

1% cashback and no annual fee Read our full review

Rob

Rob

Comments (178)