British Airways drops its trial of ‘no taxes’ short-haul Avios flight redemptions

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

Back in April we told you about something very interesting. British Airways was trialling Avios redemptions with virtually ZERO taxes.

This was showing on the longer short haul routes such as Greece, the south of Italy, Cyprus, Morocco etc.

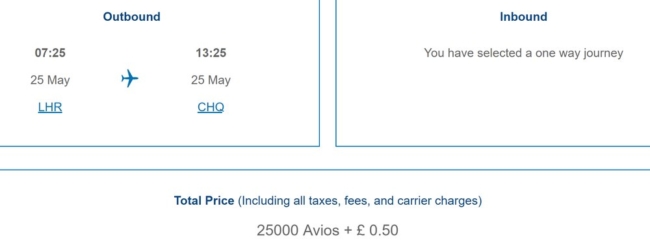

Take a look at the screenshot below, taken in April. It shows a one-way Avios redemption on British Airways from London Heathrow to Chania in Greece.

If you look at our full list of Avios redemption pricing by route (click here), you will see that Chania costs 20,000 Avios per person in Club Europe each way.

I would expect to see a price of 20,000 Avios + £25 for a Reward Flight Saver one-way redemption.

Instead, this is what you saw in April (click to enlarge):

The ‘headline’ price is shown as 25,000 Avios + 50p in taxes and charges.

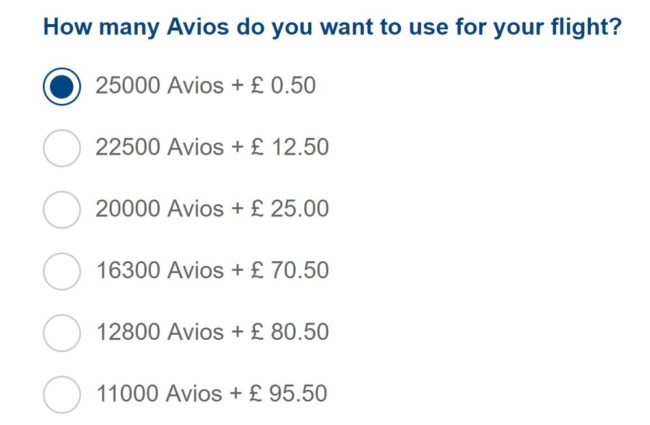

When you click through to the payment page, you are given this list of options:

The ‘proper’ price of 20,000 Avios + £25 was still there. However, two additional options were shown:

25,000 Avios + 50p

22,500 Avios + £12.50

These two new options were very poor value.

In the first one, you were using 5,000 additional Avios to save £24.50. This meant you were getting 0.49p per Avios. This is very poor.

In the second example, you were using 2,500 additional Avios to save £12.50. This meant you were getting 0.5p per Avios. Again, very weak.

There was one upside. If your plans were tentative, you would basically have no cancellation fees, as the fee is the lower of £35 or the cash supplement paid.

Similar pricing showed if you looked at Economy redemptions.

Now it has gone

The trial seems to have ended before most people ever found out it existed.

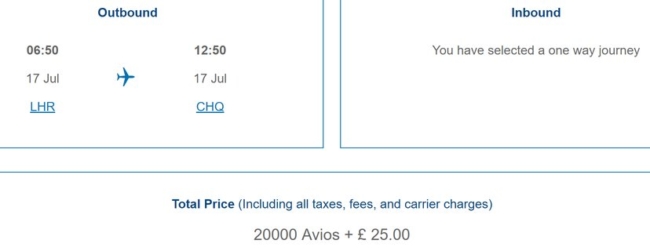

Here is a screenshot of a Chania redemption that I took on Saturday:

The ‘no taxes’ options have gone. The cheapest option is back to what it used to be – 20,000 Avios + £25 one-way in Club Europe.

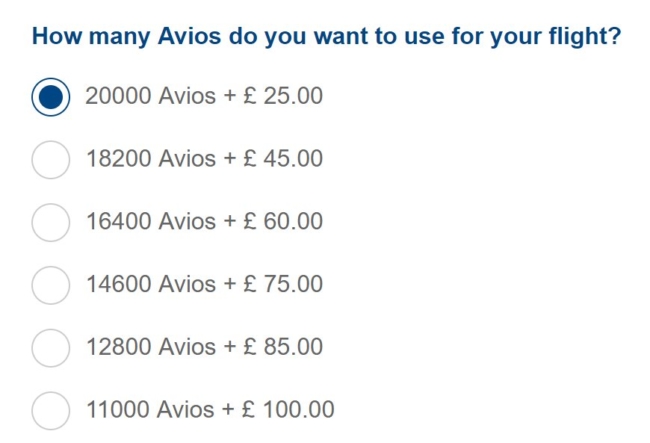

And if you click through, it is still not there:

Was this just a test or is BA still planning to roll it out?

British Airways isn’t daft. It knows that the marketing benefits of ‘no taxes’ short-haul redemptions would be substantial, even though it means the airline handing over its own cash for Air Passenger Duty.

Of course, the trial wasn’t exactly offering you great value. This is ironic since, on the face of it, removing the RFS fee in return for a large pile of Avios probably makes the scheme look better to the casual traveller.

You’d need to be a little crazy to accept 0.5p per Avios if you earned your points from credit card spending, Tesco Clubcard conversions, Heathrow Rewards conversions etc.

On the other hand, you may be happy with this if all your points came from flying. It gives people more options and that is generally a good thing.

Let’s see if this really was a one-off trial or the precursor of a larger change.

How to earn Avios from UK credit cards (December 2021)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points, such as:

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Run your own business?

We recommend Capital On Tap for limited companies. You earn 1 Avios per £1 which is impressive for a Visa card, along with a sign-up bonus worth 10,500 Avios:

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

You should also consider the British Airways Accelerating Business credit card. This is open to sole traders as well as limited companies and has a 30,000 Avios sign-up bonus:

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

(Want to earn more Avios? Click here to visit our home page for our latest articles on earning and spending your Avios points and click here to see how to earn more Avios this month from offers and promotions.)

Comments (34)