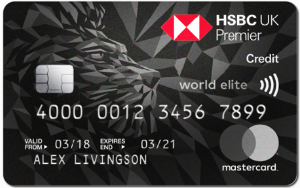

What are the benefits of the HSBC Premier World Elite Mastercard?

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

Why should you get the HSBC Premier World Elite Mastercard?

Today, I want to look at the top 10 card benefits you get if you apply for a HSBC Premier World Elite Mastercard credit card.

Here is the legal information we need to tell you:

Sign-up bonus and earnings rate:

- Get 80,000 HSBC points, paid over two years

- Earns 2 HSBC points per £1 spent

- Points convert at 2:1 into Avios

Other information:

- Only available to HSBC Premier account holders

- Receive free airport lounge access with LoungeKey

- Annual fee: £195

Representative 59.3% APR variable based on an assumed £1,200 credit limit and £195 annual fee. Interest rate on purchases 18.9% APR variable.

The sign-up bonus on the HSBC Premier World Elite Mastercard is 80,000 points.

This is paid in two parts. You receive 40,000 HSBC points (worth 20,000 Avios or other airline miles) for spending £2,000 within three months and a further 40,000 HSBC points (=20,000 miles) for spending £12,000 within twelve months.

The annual fee is £195 and you need to pay the fee for the second year in order to receive the second half of the bonus.

There is no restriction on receiving the bonus if you have previously held the card, as long as you cancelled it over six months ago, or are upgrading from the free HSBC Premier Mastercard.

The points earned with the HSBC Premier World Elite Mastercard can be transferred to four airline frequent flyer schemes – British Airways Avios, Cathay Pacific Asia Miles, Etihad Guest or Singapore Airlines KrisFlyer.

They can also be redeemed for other items including retailer gift cards.

Cardholders can access any airport lounge in the LoungeKey network for free. No guest are allowed, but you can get your partner a supplementary credit card on your account for an annual fee of £60. Children would be charged at £20 per visit.

You need to be a HSBC Premier current account holder to apply for this card. HSBC Premier comes with a range of additional benefits including comprehensive travel insurance.

The top 10 benefits of the HSBC Premier World Elite Mastercard

1. There is a VERY generous sign-up bonus

You will receive 40,000 HSBC points when you spend £2,000 within your first three months.

You get an extra 40,000 points if you spend £12,000 in your first year. This arrives after you have the paid the non-refundable fee for the second year.

One HSBC point gets you 0.5 frequent flyer miles, so the bonus is potentially worth 40,000 airline miles.

2. The points you earn convert into FOUR different airlines

HSBC credit card points are HUGELY flexible because you can convert them into lots of different things. You aren’t stuck with Avios, Virgin Flying Club miles or whatever. You can keep them with HSBC for as long as you want and only convert them when you need them.

Airline partners are Avios, Singapore Airlines Krisflyer, Etihad Guest and Asia Miles.

3. You receive two HSBC points for every £1 you spend on the card

There are a few exceptions (cash withdrawals do not earn points) but in reality virtually every £1 you spend will earn another two HSBC points.

One HSBC point is worth 0.5 airline miles, so you are getting 1 mile per £1 spent.

4. You receive DOUBLE POINTS when you spend in a foreign currency

Unfortunately, the HSBC Premier World Elite Mastercard adds a 3% foreign exchange fee when used outside the UK. This means that the double points offer is not as generous as it appears.

Unfortunately there are no travel rewards card without a foreign exchange fee. One option is to get a free Curve Card – see this HfP article – and link it to a miles-earning Visa or Mastercard.

Another option is to get a free card from Currensea. Currensea is a simple but clever idea. You pay abroad with your Currensea Mastercard debit card. Currensea translates the cost to Sterling with just a 0.5% fee (83% less than HSBC charges) and withdraws the money from your bank account. You can find out more by clicking here. Currensea is free so there is no risk in giving it a try.

Of course, if you are spending abroad for business and your employer is reimbursing you, you should put your spending onto the HSBC card ….

5. This is the most generous Visa or Mastercard for earning Avios

At 1 mile per £1, this card is far more generous than the other way of earning Avios from a Visa or Mastercard – via NatWest MyRewards. This card does not have a fee as high as £195, of course.

6. As a Mastercard, it is far more flexible than an Amex card

Many of the travel rewards credit cards we cover are American Express cards. The problem with these is that they are not universally accepted.

As a Mastercard, the HSBC Premier World Elite credit card is accepted virtually everywhere that cards are taken.

7. You receive free airport lounge access

Your HSBC Premier World Elite Mastercard comes with a LoungeKey card. This gets you access to a global network of airport lounges.

You cannot take a guest for free, unfortunately. They are charged at £20.

8. You can add a supplementary cardholder for £60 to give them airport lounge access too

You can pay £60 per year to give a supplementary HSBC Premier World Elite card to your partner. This would allow them free airport lounge access and is a better deal than paying the £20 guest fee on a regular basis.

9. You receive other special travel offers

HSBC Premier World Elite customers get a 10% discount on hotel bookings via Expedia and Agoda. You also receive 12 months of free Expedia+ Gold membership.

10. You get many other benefits via your HSBC Premier current account, including free travel insurance

You need to have a HSBC Premier current account to take out the HSBC Premier World Elite Mastercard.

HSBC Premier is free although you need to earn £75,000 or have substantial investments with HSBC, and the benefits include free comprehensive travel insurance.

Conclusion

The HSBC Premier World Elite Mastercard is a very generous card for high spenders, given the earning rate of 1 airline miles per £1 spent. The only catch is the requirement to have a HSBC Premier current account before you can apply.

You can sign up for the HSBC Premier World Elite Mastercard, if you already have a HSBC Premier current account, or find out more information, on the official website here.

Sign-up bonus and earnings rate:

- Get 80,000 HSBC points, paid over two years

- Earns 2 HSBC points per £1 spent

- Points convert at 2:1 into Avios

Other information:

- Only available to HSBC Premier account holders

- Receive free airport lounge access with LoungeKey

- Annual fee: £195

Representative 59.3% APR variable based on an assumed £1,200 credit limit and £195 annual fee. Interest rate on purchases 18.9% APR variable.

The sign-up bonus on the HSBC Premier World Elite Mastercard is 80,000 points.

This is paid in two parts. You receive 40,000 HSBC points (worth 20,000 Avios or other airline miles) for spending £2,000 within three months and a further 40,000 HSBC points (=20,000 miles) for spending £12,000 within twelve months.

The annual fee is £195 and you need to pay the fee for the second year in order to receive the second half of the bonus.

There is no restriction on receiving the bonus if you have previously held the card, as long as you cancelled it over six months ago, or are upgrading from the free HSBC Premier Mastercard.

The points earned with the HSBC Premier World Elite Mastercard can be transferred to four airline frequent flyer schemes – British Airways Avios, Cathay Pacific Asia Miles, Etihad Guest or Singapore Airlines KrisFlyer.

They can also be redeemed for other items including retailer gift cards.

Cardholders can access any airport lounge in the LoungeKey network for free. No guest are allowed, but you can get your partner a supplementary credit card on your account for an annual fee of £60. Children would be charged at £20 per visit.

You need to be a HSBC Premier current account holder to apply for this card. HSBC Premier comes with a range of additional benefits including comprehensive travel insurance.

Disclaimer: Head for Points is a journalistic website. Nothing here should be construed as financial advice, and it is your own responsibility to ensure that any product is right for your circumstances. Recommendations are based primarily on the ability to earn miles and points and do not consider interest rates, service levels or any impact on your credit history. By recommending credit cards on this site, I am – technically – acting as a credit broker. Robert Burgess, trading as Head for Points, is regulated and authorised by the Financial Conduct Authority to act as a credit broker.

Want to earn more points from credit cards? – December 2021 update

If you are looking to apply for a new credit or charge card, here are our November 2021 recommendations based on the current sign-up bonus.

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the top current deals:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers.

American Express Business Gold

20,000 points sign-up bonus and free for a year Read our full review

American Express Business Platinum

40,000 points sign-up bonus and a long list of travel benefits Read our full review

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending:

Barclaycard Select Cashback Credit Card

1% cashback and no annual fee Read our full review