GOOD NEWS: American Express reinstates the old rules for Platinum travel insurance

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

Good news.

American Express has reinstated the old Terms & Conditions for the travel insurance benefit that comes with The Platinum Card.

There was a huge outcry from Head for Points readers when we highlighted the original change last week. To put it into perspective, the original article was read over 25,000 times on the site – this was DOUBLE the 2nd most read article last week. It was also read by our 13,000 email subscribers.

What is the rule now?

Here is a link to the travel insurance Terms & Conditions on The Platinum Card website.

Last week, American Express changed the wording (under the definition of ‘Account’) to say that you must pay on The Platinum Card to be fully covered by the insurance.

This was bad news, because many HfP readers preferred to pay with a different American Express card. After all:

British Airways American Express Premium Plus offers double points on BA flight bookings at ba.com, earns 1.5 Avios per £1 on all other spend and spend counts towards your 2-4-1 Avios voucher (£10,000 spend required)

Preferred Rewards Gold offers double points for airline spend and double points abroad, and earns you 10,000 bonus Membership Rewards points when you spend £15,000 per card year

Starwood Preferred Guest American Express offers double points at Marriott hotels

All of these cards are a better choice than paying with The Platinum Card which only offers 1 Membership Rewards point per £1 spent.

The old wording has now returned.

Look at the document now and it says that you can pay with (under the definition of ‘Account’):

“your consumer and small business cards issued by American Express in the UK, excluding corporate cards and any American Express cards issued by bank partners”

…. and still be covered. American Express has confirmed to me that the old wording is back permanently.

How does the Amex Platinum insurance work?

As a quick reminder, for medical and other ‘big stuff’, you are covered irrespective of how you paid for your trip.

However, for claims under the categories below, you needed to have paid with a qualifying American Express card – which last week changed to just The Platinum Card:

- Cancelling, Postponing and Abandoning your Trip

- Cutting Short your Trip

- Travel Inconvenience

- Personal Belongings, Money and Travel Documents

- Purchase Protection

- Refund Protection

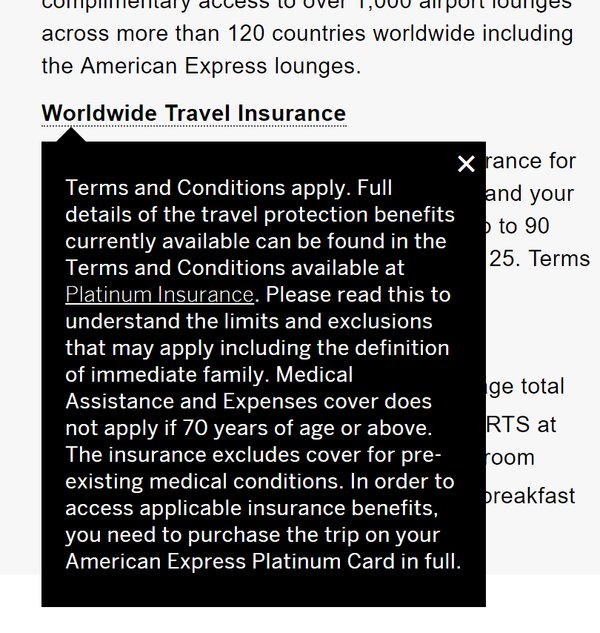

Note that the Amex website is not yet fully fixed

The insurance documentation has now been updated.

As of last night, however, The Platinum Card website still showed the following (click to enlarge):

…. which still insists that a Platinum card is used for payment. Hopefully this will get updated soon.

Thanks to everyone who complained to American Express, either directly or via social media, following our article last weekend.

Want to earn more points from credit cards? – December 2021 update

If you are looking to apply for a new credit or charge card, here are our November 2021 recommendations based on the current sign-up bonus.

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the top current deals:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers.

American Express Business Gold

20,000 points sign-up bonus and free for a year Read our full review

American Express Business Platinum

40,000 points sign-up bonus and a long list of travel benefits Read our full review

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending:

Barclaycard Select Cashback Credit Card

1% cashback and no annual fee Read our full review

Comments (169)