We review N26, the UK’s latest ‘online only’ bank – how does it compare to Revolut or Monzo?

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

EDIT: Unfortunately, N26 closed its UK operation in February 2020 and it is no longer possible to open an account

This is our N26 review, looking at the UK’s latest ‘app only’ bank. How does it stack up?

N26 is the latest ‘challenger bank’ to launch in the UK. It follows in the footsteps of Revolut, Monzo, Starling and Monese, although it is actually older than all of them. N26 is a German bank which is now rolling out across Europe following its success at home. The UK is the latest launch following Ireland, France, Italy, Spain, Austria, the Netherlands and Belgium.

The key things you need to know about N26 are:

It is FREE to open an account

You can open an account online in 8 minutes (so they claim) via their website here

This means that you have nothing to lose by signing up and giving it a try.

What does N26 offer you?

A standard N26 account is FREE for life. There are plans to launch an optional premium tier with extra benefits very soon but, for the moment, all accounts are free.

With N26, you are moving your banking relationship entirely online. It has no branches at all, which means you can’t pay in cash over a counter or pay in cheques. This means that you would need to keep your existing branch-based bank account for the very rare occasions when you have a cheque or some cash to deposit.

N26 offers a range of benefits that will be familiar from other online banks. You sign up via the website here and then:

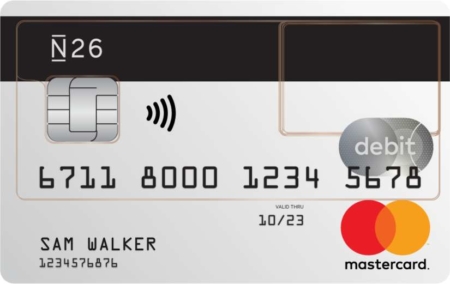

You receive a Mastercard debit card – which comes in funky clear plastic, as you can see in the photo above – in the post (free, which is £4.99 cheaper than Revolut)

You get a sort code and account number, allowing you to use N26 as you would a traditional current account

You receive push notifications of all transactions in and out

You can send and receive money from friends via the app

You pay 0% FX fees on overseas transactions (with no monthly limit and no weekend surcharges, unlike Revolut)

You can pay with Google Pay and Apple Pay

You can set up direct debits against your N26 account

You can withdraw cash for free from UK ATMs

The only charges you are likely to pay are:

Withdrawals from non-UK cash machines: 1.7% fee (Revolut allows one free £200 monthly overseas withdrawal)

14.9% interest rate if you go overdrawn

N26 does offer international money transfers but this is done via a partnership with TransferWise. If this is important to you than Revolut (see our main Revolut review here) is probably a better option as it offers £5,000 per month of transfers for free.

There is a £20,000 limit on your monthly card payments and a £5,000 daily limit, which I doubt many people will hit. You can see the full list of fees here (PDF).

You can’t see from the image above that the card is see-through, but it is!

If you are a regular traveller, the key benefit of N26 is 0% foreign exchange commission on all purchases overseas. Virtually all UK debit and credit cards add a 2.99% foreign exchange surcharge when you buy something overseas. This can easily add up – you are looking at £60 on a £2,000 holiday spend.

Even if you have no intention of moving your day to day banking to N26, opening a free N26 account and funding it from your existing current account will save you money when you travel. You can easily move any spare funds back to your main bank account via the app when you get home.

Does our review convince you about N26?

N26 is an interesting addition to the current online banking ranks of Monzo, Starling, Revolut etc, all of whom offer very similar products.

Our review of Starling Bank is here if you want to compare.

N26 gives the impression of being a slightly more grown-up and simpler package than some of its competitors, but at the end of the day the features are similar.

If N26 sounds interesting, I’d recommend signing up and giving a try. It literally costs you nothing, the sign-up process is meant to take under 10 minutes, and if you find the ‘app and card’ banking model isn’t for you then you haven’t lost anything.

You can find out more about N26, and join for free, on its website here.

Want to earn more points from credit cards? – December 2021 update

If you are looking to apply for a new credit or charge card, here are our November 2021 recommendations based on the current sign-up bonus.

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the top current deals:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers.

American Express Business Gold

20,000 points sign-up bonus and free for a year Read our full review

American Express Business Platinum

40,000 points sign-up bonus and a long list of travel benefits Read our full review

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending:

Barclaycard Select Cashback Credit Card

1% cashback and no annual fee Read our full review