Get bonus Avios and Virgin Flying Club miles from Tesco via the Pay+ app

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

I wanted to flag up this offer again today as it is a few months since we mentioned it and it is valid until the end of the year.

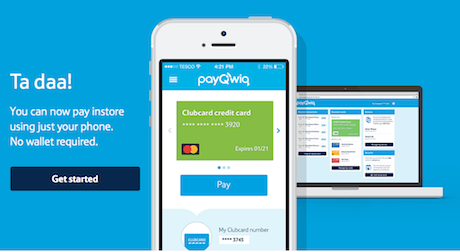

Tesco has a smartphone payment app called Pay+ (previously PayQwiq, a name that was dropped when they realised no-one could remember how to spell it).

It is Tesco’s payment app which let’s you pay your shopping and automatically collect Clubcard points. Pay+ works a bit like Apple Pay or Android Pay, but with the added benefit of automatically adding your Clubcard number to the transaction so you don’t need to dig out your blue card.

To encourage people to try Pay+, until 31st December 2018 you will get 1 extra Clubcard point for every £4 spent in Tesco. This is a decent offer, worth an extra 0.6 Avios per £1 or 0.625 Virgin Flying Club miles for every £1 of Tesco shopping you do. It is a bit of a faff to set up Pay+ but once you’ve done it you’re good to earn bonus miles for the next five months.

You can read more about Pay + here. You will still receive all your usual loyalty points from your credit card too.

How to earn Avios from UK credit cards (December 2021)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points, such as:

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Run your own business?

We recommend Capital On Tap for limited companies. You earn 1 Avios per £1 which is impressive for a Visa card, along with a sign-up bonus worth 10,500 Avios:

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

You should also consider the British Airways Accelerating Business credit card. This is open to sole traders as well as limited companies and has a 30,000 Avios sign-up bonus:

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

(Want to earn more Avios? Click here to visit our home page for our latest articles on earning and spending your Avios points and click here to see how to earn more Avios this month from offers and promotions.)

Rob

Rob

Comments (139)