NEW: Book an Avios flight now, earn the Avios later

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

Avios has launched, as a trial, ‘Avios Advance’. This has been knocking around for a while on a limited basis but is now popping up for more and more people.

This is something new for airline loyalty programmes although Marriott has been doing it for years with its hotel programme.

You can book an Avios flight even if you don’t have enough points. You have until 35 days before departure to earn them.

How does it work?

This is an avios.com initiative. You will not find it on ba.com and so you cannot combine it with a British Airways American Express 2-4-1 voucher.

If all of your Avios are in British Airways Executive Club, you will need to move them over to avios.com before you can do this.

The exact rules for ‘Avios Advance’ have not been published. This is how it seems to work – but please do not take this information as fully accurate:

You seem to need to book 6 months ahead of travel

You seem to need to have 75% of the Avios required already in your account

Note that there is no guarantee that you will be offered ‘Avios Advance’ even if you do meet these criteria.

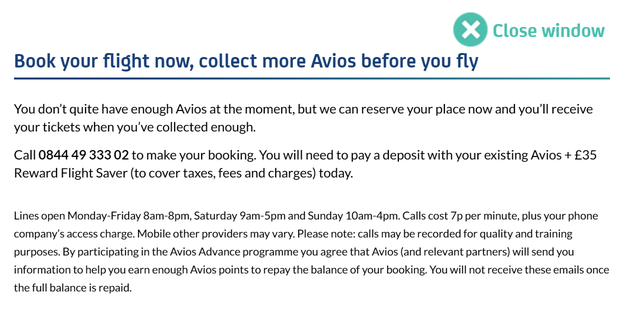

Go through the flight booking process on avios.com and, assuming your potential booking meets the criteria above, the box above will appear on screen.

It invites you to ring the Avios call centre and make your booking. This is what happens:

Avios reserves your seat

You pay your existing Avios balance plus the full taxes for the ticket (the box only mentions £35 Reward Flight Saver taxes but I assume you need to pay the full taxes figure)

You have until 35 days before departure to earn the balance of the Avios required

It isn’t clear what happens if you don’t have the remaining Avios in your account 35 days before travel. Do you forfeit your ‘deposit’ (ie all of the Avios you used)? That sounds too excessive. I am guessing that the booking is cancelled and you receive your Avios and taxes back less the usual £35 cancellation fee.

What do I think?

This is an interesting move by Avios. It is customer friendly but also has the potential to cost Avios money:

It saves the customer from buying Avios points to top up their account at the punitive 1.6p per point rate

It creates additional call centre work as these bookings cannot be made online

Let’s see how it goes – the fact that it is now being offered more widely implies they are happy with it. Hopefully it will be a success.

PS. The Marriott version of this scheme is FAR more generous. Marriott Rewards members can make reward redemptions without having any points in their account, You have until seven days before arrival to earn the points you need. I have a Ritz-Carlton booking for October currently booked via this route.

How to earn Avios from UK credit cards (December 2021)

As a reminder, there are various ways of earning Avios points from UK credit cards. Many cards also have generous sign-up bonuses!

There are two official British Airways American Express cards with attractive sign-up bonuses:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

You can also get generous sign-up bonuses by applying for American Express cards which earn Membership Rewards points, such as:

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Run your own business?

We recommend Capital On Tap for limited companies. You earn 1 Avios per £1 which is impressive for a Visa card, along with a sign-up bonus worth 10,500 Avios:

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

You should also consider the British Airways Accelerating Business credit card. This is open to sole traders as well as limited companies and has a 30,000 Avios sign-up bonus:

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Click here to read our detailed summary of all UK credit cards which earn Avios. This includes both personal and small business cards.

(Want to earn more Avios? Click here to visit our home page for our latest articles on earning and spending your Avios points and click here to see how to earn more Avios this month from offers and promotions.)

Rob

Rob

Comments (55)