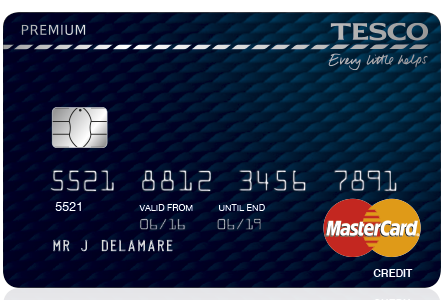

Exclusive: Tesco Premium Credit Card launched this morning

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

I was on my way to Starbucks with my little ‘un an hour ago when I got a call from Tesco Bank telling me that the Premium Credit Card was now open for applications.

I am dashing off to Heathrow in a few minutes so a full review will have to wait until Monday.

You can check out the details here. The representative APR is 56.5% variable, including the fee, assuming a £1200 credit limit.

I am interested in your thoughts.

It is not as bad as we first thought, but it is still not great:

5,000 bonus points for spending £5,000 per year IN TESCO is very tough

The ‘£50 off a Club Europe flight’ voucher could be valuable but the code expires after two months

I haven’t looked at the small print of the travel insurance to see if it is comprehensive

The lack of a sign-up bonus means you might want to wait

I will ponder it over the weekend ….

There is one bit of good news though. The British Airways £50 discount, and the various mentions of Avios and Flying Club miles on the card website, should put to rest any thoughts that Tesco Clubcard will be withdrawing from Avios.

Want to earn more points from credit cards? – December 2021 update

If you are looking to apply for a new credit or charge card, here are our November 2021 recommendations based on the current sign-up bonus.

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the top current deals:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers.

American Express Business Gold

20,000 points sign-up bonus and free for a year Read our full review

American Express Business Platinum

40,000 points sign-up bonus and a long list of travel benefits Read our full review

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending:

Barclaycard Select Cashback Credit Card

1% cashback and no annual fee Read our full review

Comments (59)