HSBC no longer taking £TC’s from June 27 – last chance to boost Amex sign-up spend

Links on Head for Points may pay us an affiliate commission. A list of partners is here.

If you need to boost your American Express spend to hit a sign-up bonus, one way to push yourself nearer to the target is to buy some Sterling travellers cheques from American Express Currency Exchange.

As I have written numerous times on Head for Points, American Express treats an order of foreign currency or travellers cheques as a PURCHASE and not as a cash withdrawal.

This ONLY applies if you make your transaction via their own travelmoneynow website and ONLY if you use an Amex-issued American Express card. Lloyds Amex and MBNA Amex cards do not qualify.

There are three advantages of doing this:

You don’t pay a cash advance fee when buying foreign currency or travellers cheques (although there is a 1.5% fee for £ travellers cheques)

You earn Membership Rewards points, Avios, SPG points or Nectar points via your Amex card

You get nearer to the sign-up bonus on your American Express card

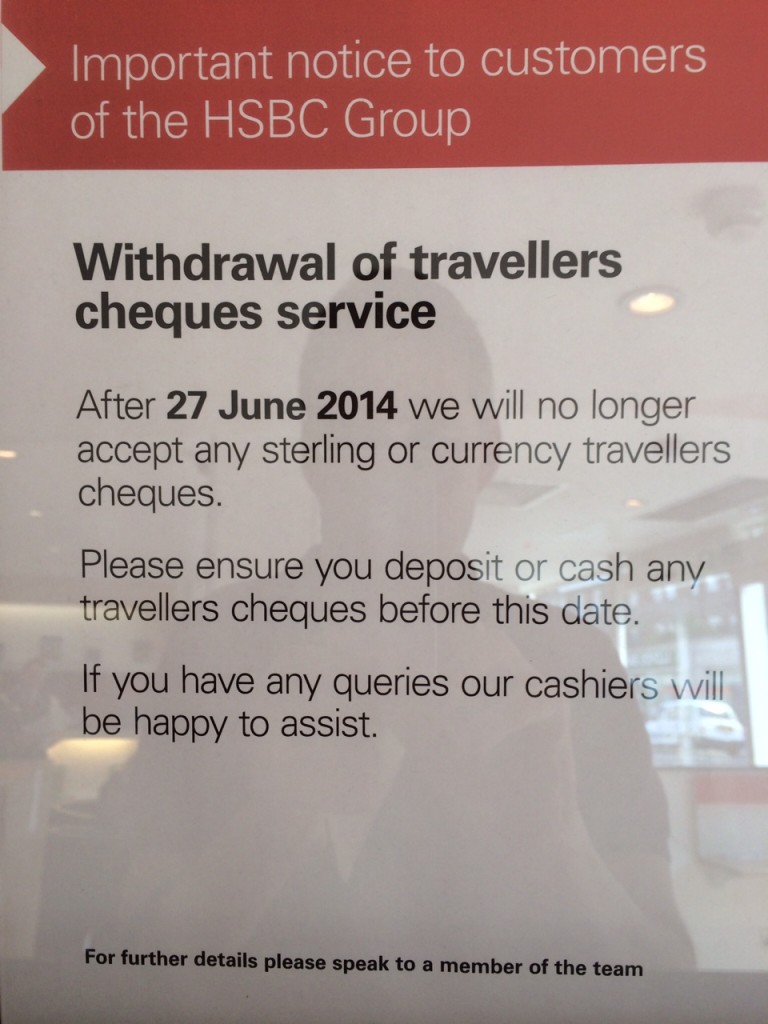

You used to be able to pay Sterling travellers cheques into UK bank accounts without any problems. In the last couple of years it has got harder with some banks withdrawing totally. HSBC is now following suit.

From June 27th, you will not be allowed to pay £ travellers cheques into your HSBC bank account. This means, of course, that for the next 10 days you can do it without any problems.

Amex is aware that using a credit or charge card to order currency is an easy fraud route. It imposes arbitrary limits on how much – if any – currency and travellers cheques it will let you buy.

That said, if you are £500 short of hitting the sign-up bonus on your new Amex card, paying the £7.50 fee to order £500 of Sterling travellers cheques – and immediately paying them into your bank account – is a decent deal. Be very careful before doing this that your bank will still accept them. If you have a HSBC account you may just be able to squeeze in an order in time.

Want to earn more points from credit cards? – December 2021 update

If you are looking to apply for a new credit or charge card, here are our November 2021 recommendations based on the current sign-up bonus.

You can see our full directory of all UK cards which earn airline or hotel points here. Here are the top current deals:

British Airways American Express

5,000 Avios for signing up, no annual fee and an Economy 2-4-1 voucher for spending ….. Read our full review

British Airways American Express Premium Plus

25,000 Avios and the UK’s most valuable credit card perk – the 2-4-1 companion voucher Read our full review

American Express Preferred Rewards Gold

Your best beginner’s card – 20,000 points, FREE for a year & two airport lounge passes Read our full review

The Platinum Card from American Express

30,000 points and an unbeatable set of travel benefits – for a fee Read our full review

Earning miles and points from small business cards

If you are a sole trader or run a small company, you may also want to check out these offers.

American Express Business Gold

20,000 points sign-up bonus and free for a year Read our full review

American Express Business Platinum

40,000 points sign-up bonus and a long list of travel benefits Read our full review

British Airways Accelerating Business American Express

30,000 Avios sign-up bonus – plus annual bonuses of up to 30,000 Avios Read our full review

Capital On Tap Business Rewards Visa

The most generous Avios Visa or Mastercard for a limited company Read our full review

For a non-American Express option, we also recommend the Barclaycard Select Cashback card for sole traders and small businesses. It is FREE and you receive 1% cashback on your spending:

Barclaycard Select Cashback Credit Card

1% cashback and no annual fee Read our full review

Rob

Rob

Comments (44)